一篇關于退休儲蓄挑戰的課題

今年有幸得到《資匯》財經周刊的記者潔敏采访一篇關于退休儲蓄挑戰的課題。

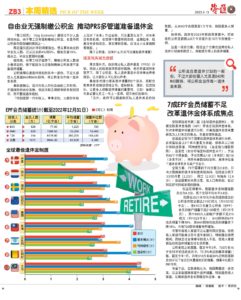

她说:“根據安聯一份《安聯退休金指數》報告指出,我国2021年底一共提领了210亿欧元(约1023亿令吉)的公积金,其中610万名雇员公积金局(EPF)会员的户头低于2100欧元(约1万227令吉),更有360万人的储蓄少于210欧元(约1022.76令吉)。B40群体的储蓄下降了38%、M40群体减少18%,而T20则有所增加。

由此可見疫情後通脹攀升,導致人們退休儲蓄款項大減。因此,安聯也在報告中提出3個建議,包括提高繳納率、政府補貼、以及延長退休年齡。“

她让我道出以下:

1.針對這3個建議,您覺得哪一個更適用于大馬?

2.除了這3個建議外,還有什麼方式是可以提高國人退休儲蓄?

3.不少年輕人會選擇轉向自由業者方式,來避免繳納公積金,您如何看這個方式?

以下皆为个人意见

1)在政府颁令疫情期间可以自行提取公积金,大多数人民都纷纷提款,导致大马人民退休储蓄下降。基本上这项措施是让那些真的穷到没钱吃饭的人提款的,可是很多人看见有机会提款,就不放过这个机会。这是导致储蓄大幅度下降的原因。而仔细看看内在的原因,为什么那么多人提款?难道这些人没有想过现在提出来的钱,就是用着未来的老人金吗?大家都懂,只是那个“未来”的危机感不胜于“现在”的困境。

安联的提议为提高缴纳率、政府补贴、以及延长退休年龄。我个人认为提高每个月的公积金缴纳率更为直接、见效的。想象一下,如果一个人的年薪是100千,多1%的缴纳率,20年后,这笔数目加上复利以及每年加薪的幅度,是一笔可观的数目。

其次,必须要加强严管提款的条规,不让人民随随便便就提款出来。我亲身看见有人把钱提了出来后,把它投入不当的投资工具,结果坎坷。如果没有强制性地储蓄,人民又缺乏理财的知识,当社群老年化,而大部分的人不足够养老金,没法安逸晚年时,就会衍生出很多民生问题。如近日新闻有老翁因孩子断绝供养,导致到处讨生活费。

那么如果说是政府补贴,国库有限,细看国库每年的赤字,试问如何供给补贴,即使可以,又有哪些群体会受惠?受惠的影响又有多大?每个人拿的补贴100?200?真的有帮到忙吗?还是使国库负担更大的开销?

延长退休年龄时在所难免的,即使是现在,一般人民过了60岁,也还会继续工作。所以本人不觉得这项措施会有如何的影响力。

2)除了这3项提议,有两个管道可以提高国人的退休储蓄。第一,从大众化层面,更多的理财意识需要加强注射在普及市场。可以配合各个教育体系或是培训领域的公司,提供财务、理财、投资的知识,让更多人受惠,理解到退休储蓄的重要性。比如:每家公司务必要让员工一年上一堂课,提升他们的财商。

第二,政府可以在税务减免款项中,大幅度增高私人退休计划的税务减免数额。例子:从RM 3,000 提高至 RM 10,000 。这将促使更多人把钱存进退休储蓄。在2023年预算案,政府把自愿性公积金数额从 RM 60,000 提升至 RM 100,000, 也把人寿保险的减免加阔涵盖自愿性公积金减免高达 RM 4,000,本人认为这是一项很好的方案。那如果把这个方案也用在私人退休计划减免款项,务必能提升国人的退休储蓄。

3)如果大多数人都向着自由业发展,只因为了避免缴纳公积金,我不认同这个说法。我个人认为,现代年轻人更向往自由的工作时间,才选择向自由业发展。但是又因为缺乏理财和财务规划的知识,不觉得需要资源储蓄退休金而已。

现在新一代的年轻人,什么都要快,大部分的年轻人对“未来”没有作很多的安排。原因也许是“活在当下最自在”。对未来没有危机感,也觉得没什么好安排,逆来顺受就好。其实追溯起来,也就是那个对金钱管控的思维不够全面。其实理财思维,应该从小就从家庭教育灌输。

在采访后的两周,她发给我刊登出来的报导!肚子里满是墨水果然非同凡响,整个文章看起来得体又客观,而且还有幸可以和迈悦理财教育机构创办人周志强,我在财务界的偶像一起做专访!真的是开心到……

希望各界多多关注理财这一方面的知识哦!不懂哪里开始?就跟着小红帽理财规划师一起看金学堂吧!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Annie Wong 黄如金

Annie is a passionate trainer who was inspired by her idol to teach what she learned and to give what she earned. She has more than 10 years of experience in the field of training and SME business consulting.

She graduated with a Bachelor in Science from Campbell University Summa cum laude (First Degree Distinction). She was awarded book prizes and Matthew Bailey Prize Award due to her distinguished academic performance. She then pursued her career switch from a Pharmaceutical Regional Manager to a Financial Consultant.

Currently, Annie is an internationally recognized Certified Financial Planner (CFP Professional) cum International Certified Professional Trainer (ICPT, IPMA, UK). She is a CMSRL Financial Planner (Licensed by Securities Commission Malaysia) and has impacted people financially. She is now one of the core trainers in the Certified Financial Coach Program and is the only accredited Color Accounting Trainer, who can train in both English and Mandarin.