电子发票10月4日最新更新指南

最新的电子发票指南于 2024 年 10 月 4 日发布。

遵循 2024 年 9 月 30 日发布的电子发票公报。(关于签发电子发票的所得税规则)PUA 265/2024。

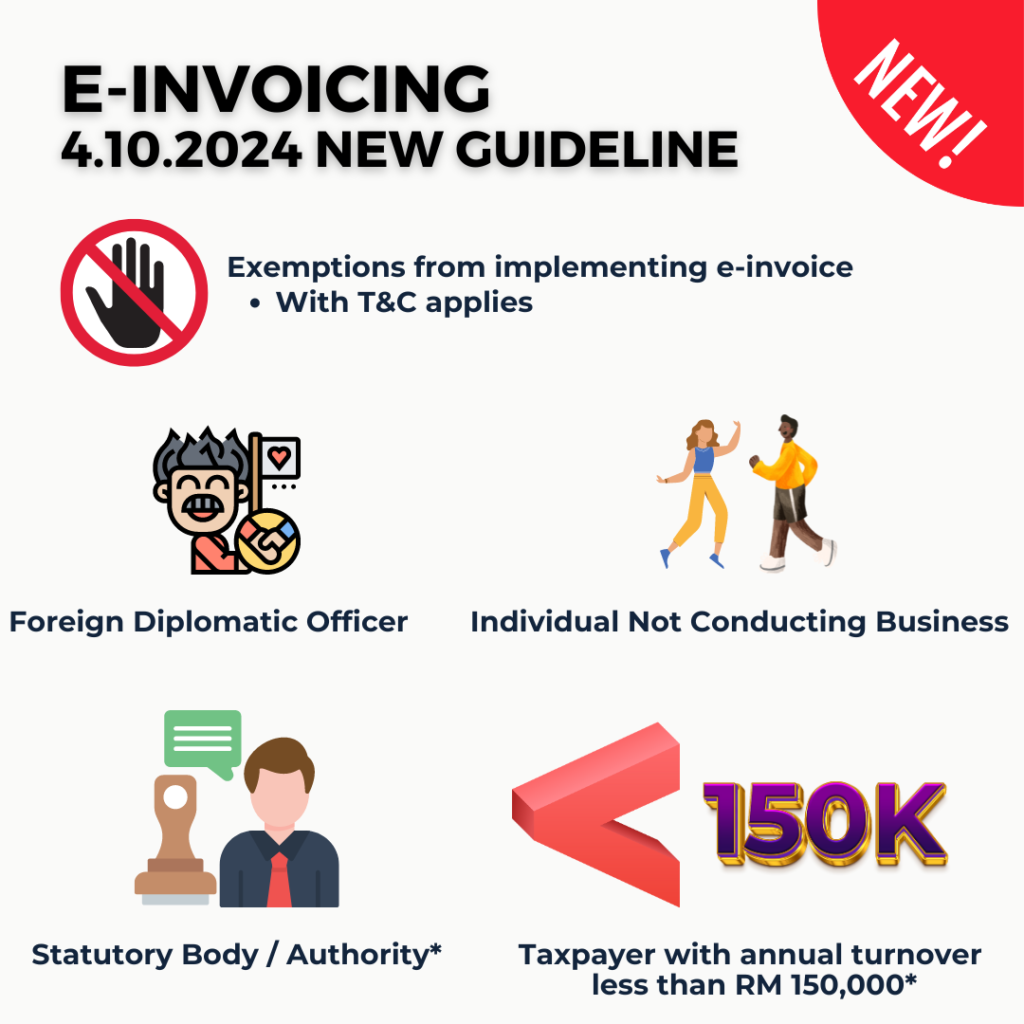

主要更新:

- 豁免类别现已从13类变更为5类

- 中小微企业豁免条款和条件

- 海外进口货物自开票电子发票处理

- 通过 FREE ZONE 进口/购买商品时的电子发票处理

简介:

- 豁免类别现已从13类变更为5类

- a) 外交办公室

- b) 不从事商业活动的个人

- c) 与以下有关的法定机构、法定当局和地方当局:

(i) 其在执行指定职能时收取的款项、费用、收费、法定征费、传票、罚金和罚款

根据任何成文法;和

(ii) 2025 年 7 月 1 日之前销售的商品和提供的服务的交易

- d) 2025 年 7 月 1 日之前出售的任何商品或提供的服务的国际组织

- e) 年营业额或收入低于 RM150,000 的纳税人

- 中小微企业豁免条款和条件

- a) 如果纳税人,根据2022年审计报告/2022年纳税申报表,年营业额低于RM150,000,则无需实施电子发票

- b) 如果纳税人业务增长,并在任何年期间,比如:2024年8月达到RM150,000,纳税人需要从2026年1月1日开始实施(随后的第二年)

- c) 如果在2026年实施电子发票后,2026年的总销售额低于15万令吉,则在2027年需要继续实施电子发票。 (没有豁免资格的后退)

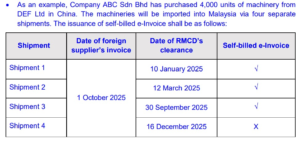

3.海外进口货物(多次发货)时的自开电子发票处理

- a) 如果国外供应商发票在所有发货之前,则在第一批发货清关时只需开具 1 张带有 K1 参考号的自开票发票。

- b) 如果外国供应商发票在发货期间,在发票日期之前,所有发货必须使用 K1 开具自开票发票。

- c) 如果外国供应商在发货后开具发票,则所有发货都必须开具自开票发票。

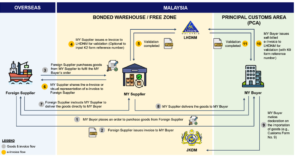

- 通过 FREE ZONE 进口/购买货物时的电子发票处理

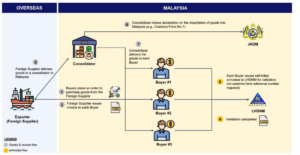

有很多场景。但总而言之,对于所有从海外进口的商品,当地购买者(无论是在自由区还是马来西亚商业区)都需要开具带有K1参考编号(从海外进口到马来西亚)或K8参考编号(从海外进口到自由区)的自开发票。

另一方面,所有销售,无论是针对自由区买家还是马来西亚买家,都需要开具电子发票。

对于通过集运商进口的货物,所谓的直运,例如:从亚马逊订购书籍。购买者没有K1参考号,因此对于自开票发票,无需注明K1参考号。但是,集运商需要对关税局呈现 过关文件(比如:K1 表格)。

如果您想要更深入地了解,欢迎报名参加我的下一次线上电子发票研讨会!

入场免费!可是位置有限!

我们会在接下来的分享会中,教会大家:

1) 电子发票 10月4日 最新更新指南

2) 选择 128 软件前必须了解的 3 件事

3) 真实案例分析,如何正确出单:Deposit/ Retention Sum/ Rental Income

4) MyInvois Portal Step-By-Step 教学

🚩 请选择分享会时间

A ) 10月 10号 【星期4】2pm-5pm

B ) 10月 15号 【星期2】 2pm-5pm

C ) 10月 17号 【星期4】 8pm-10pm

报名请点击https://bit.ly/48smEHD, 留下姓名/电邮/电话,即可。

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Annie Wong 黄如金

Annie is a passionate trainer who was inspired by her idol to teach what she learned and to give what she earned. She has more than 10 years of experience in the field of training and SME business consulting.

She graduated with a Bachelor in Science from Campbell University Summa cum laude (First Degree Distinction). She was awarded book prizes and Matthew Bailey Prize Award due to her distinguished academic performance. She then pursued her career switch from a Pharmaceutical Regional Manager to a Financial Consultant.

Currently, Annie is an internationally recognized Certified Financial Planner (CFP Professional) cum International Certified Professional Trainer (ICPT, IPMA, UK). She is a CMSRL Financial Planner (Licensed by Securities Commission Malaysia) and has impacted people financially. She is now one of the core trainers in the Certified Financial Coach Program and is the only accredited Color Accounting Trainer, who can train in both English and Mandarin.