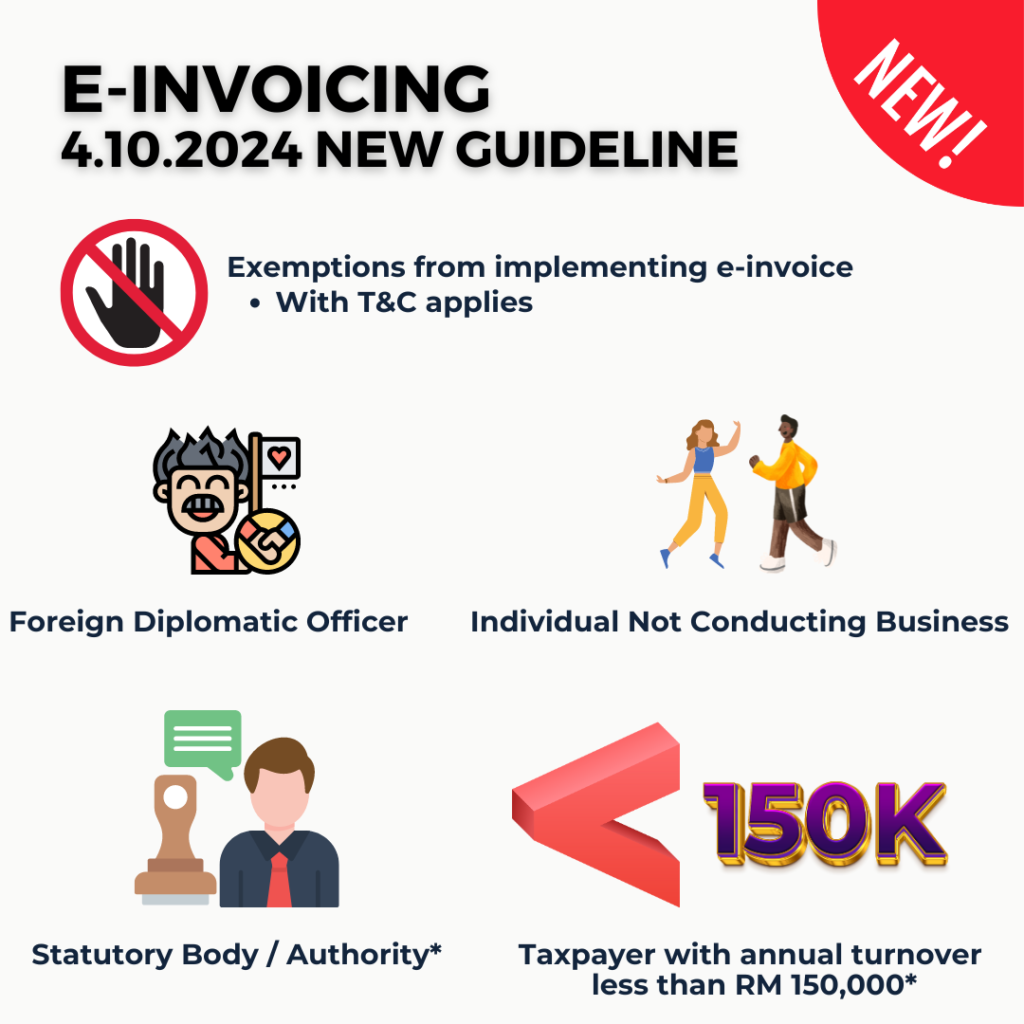

E-Invoice New Guideline Published on 4th October 2024

The latest E-Invoicing Guideline was published on 4th October 2024.

Following the E-Invoicing Gazette published on 30th Sept 2024. (Income Tax Rules on Issuance of Electronic Invoice) PUA 265/2024.

Main Changes:

- The exemptions category has now changed from 13 categories to 5 categories

- MSMEs exemption Terms & conditions

- Self-billed e-invoicing treatment when importing goods from overseas

- E-Invoice treatment when importing/purchasing goods through FREE ZONE

Summary:

- The exemptions category has now changed from 13 categories to 5 categories

a) Foreign diplomatic Office

b) Individual who is not conducting business

c) Statutory body, statutory authority and local authority, in relation to the following:

(i) collection of payment, fee, charge, statutory levy, summon, compound and penalty by it in carrying out functions assigned to

it under any written law; and

(ii) transaction of goods sold and services performed before 1 July 2025

d) International organisation for transaction of any goods sold or service performed before 1 July 2025

e) Taxpayers with an annual turnover or revenue of less than RM150,000

2. MSMEs exemption Terms & conditions

a) If the taxpayers, annual turnover is below RM 150,000 according to the 2022 audit report / Tax return YA 2022, no need to implement an e-invoice

b) If taxpayer business grows, and hits RM 150,000 on Aug 2024, taxpayers need to start implementing from 1st Jan 2026 (The second year following)

c) If after implementing e-invoice in 2026, and total sales in 2026 fall below RM 150,000, in 2027, the implementation of e-invoice needs to continue. (No fallback of exemption eligibility)

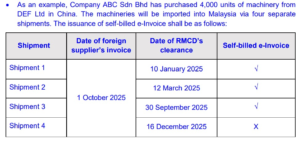

3. Self-billed e-invoicing treatment when importing goods from overseas (Multiple shipments)

a) If the foreign supplier invoice is BEFORE all the shipments, only need to issue 1 Self-Billed invoice with K1 reference number when the first shipment clears customs.

b) If the foreign supplier invoice DURING the shipments, before the invoice date, all shipments must issue self-billed invoices with K1.

c) If the foreign supplier invoices AFTER the shipments, all shipments must issue self-billed invoices.

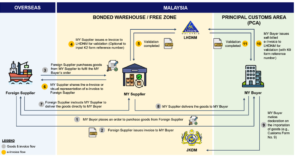

4. E-Invoice treatment when importing/purchasing goods through FREE ZONE

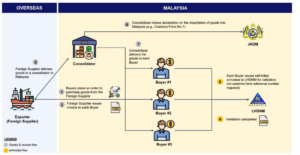

There are many scenarios. But to summarize, for all imports from overseas, the local purchaser (either in FREE ZONE or MALAYSIA Ground) needs to issue a SELF-BILLED Invoice with K1 reference number (import from overseas to Malaysia Ground) or K8 reference number (import from overseas to FREE ZONE).

In another way, all sales, either to FREE ZONE buyers or to Malaysia buyers, need to issue e-invoices.

For import goods that is through a consolidator, for example, order books from Amazon. The purchaser has no K1 reference number, so for the self-billed invoice, no need to state the K1 reference number. However, the consolidator is the one that needs to declare custom clearance with K1 reference number.

If you are keen to understand more in-depth, welcome to register for my next ENGLISH Webinar!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Annie Wong 黄如金

Annie is a passionate trainer who was inspired by her idol to teach what she learned and to give what she earned. She has more than 10 years of experience in the field of training and SME business consulting.

She graduated with a Bachelor in Science from Campbell University Summa cum laude (First Degree Distinction). She was awarded book prizes and Matthew Bailey Prize Award due to her distinguished academic performance. She then pursued her career switch from a Pharmaceutical Regional Manager to a Financial Consultant.

Currently, Annie is an internationally recognized Certified Financial Planner (CFP Professional) cum International Certified Professional Trainer (ICPT, IPMA, UK). She is a CMSRL Financial Planner (Licensed by Securities Commission Malaysia) and has impacted people financially. She is now one of the core trainers in the Certified Financial Coach Program and is the only accredited Color Accounting Trainer, who can train in both English and Mandarin.