E-Invoice Postponement | Employment Contract Stamping

As a tax planner, I’m constantly seeking clarity amidst the latest announcements from LHDN (Inland Revenue Board of Malaysia), especially with the recent news about e-invoicing delays, stamp duty exemption for employment contracts, and the expansion of SST. To get direct answers, I recently had a “teatime” session with an LHDN Officer.

Here’s a breakdown of the key questions and answers that came out of our discussion:

1) Do Contracts Before 2025 Still Require Stamping?

Answer: Yes, they do. The officer clarified that many have misunderstood the recent announcement. “Diberi Pengecualian Duti Setem” (Exemption from Stamp Duty) means you don’t have to pay the stamp duty, but it doesn’t mean “Diberi Pengecualian Dari Setem” (Exemption from Stamping altogether).

LHDN’s system has been updated to allow us to submit all documents from before 2025 for stamping. The system will detect if a contract or agreement is from before 2025 and will automatically grant a full exemption from both stamp duty and penalties.

For example: If Company ABC started operations 10 years ago and hired 30 people, with some leaving and others joining, all of those employment contracts need to be e-submitted to stamps.hasil.gov.my to get a “Stamping Copy” for peace of mind.

I asked the officer, “What if a business insists on not doing this?” The officer’s professional reply was, “We recommend you do it, especially since it’s free now. However, you have the right to choose not to. But if an LHDN officer audits you later, we don’t know what new regulations or penalties might apply then. The decision is yours.”

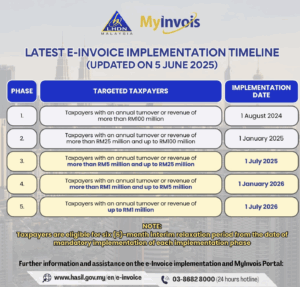

2) When Do Businesses with Varying Annual Turnover Need to Implement E-Invoicing? (e.g., RM500K in 2022, RM800K in 2023, RM1.2M+ in 2024)

Answer: It’s true that LHDN initially looked at the 2022 total turnover to determine when your business needs to start e-invoicing. However, if your 2022 turnover was less than RM500K, they will consider subsequent years. Based on the latest guidelines, if your turnover in 2024 exceeded RM1 million, you’re required to start e-invoicing from January 1, 2026, with a six-month grace period.

3) Do Contracts and Stamping Apply to Freelancers/Casual Workers? And Do We Need to Self-Bill for Payments to Them?

Answer: Hiring casual workers typically means they are freelancers, not your company’s employees. The agreement isn’t an “Employment Contract” but rather a “Service Contract.” This implies a situation like, “My business needs someone now; you’re available, so come help for three weeks, and I’ll pay you cash weekly.”

There are two scenarios here:

-

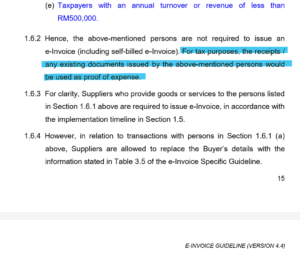

Scenario 1: Individual Freelancer (No Formal Business/Agency): If the casual worker is an individual with no formal business, company, or agency, they are considered self-employed or a freelancer. You typically won’t have a binding contract with such individuals, so no stamping is required. When your business pays them, they generally don’t need to issue an e-invoice (if their turnover is less than RM500K), and you don’t need to self-bill. A direct payment voucher is sufficient.

-

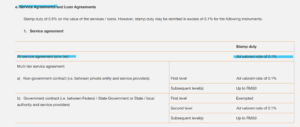

Scenario 2: Freelancer from a Human Resources Agency: If the casual worker is provided by a Human Resources Agency, then a proper Service Agreement/Contract is needed. This contract should specify the number of individuals hired, the duration, how their salaries, EPF, and SOCSO are calculated, and any benefits. This involves an “OFFER & ACCEPTANCE” and must be stamped. The stamp duty amount will depend on the contract value and is calculated at an ad valorem rate. (Source: pwc.com)

-

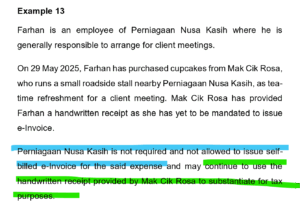

In this type of binding relationship, the supplier (the HR Agency) must issue an e-invoice to your business. If the supplier hasn’t started e-invoicing yet, a regular invoice is acceptable. You do not need to self-bill. You can refer to the “Mak Cik Rosa” example in the e-invoicing Specific Guideline for clarification.

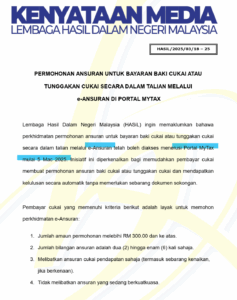

4) The Government Announced E-Ansuran (Installment Payments) Could Start on March 18th, But MyTax Isn’t Allowing It. What Now?

Answer: This is incredibly frustrating! LHDN announced it, but the system isn’t functional.

The LHDN officer admitted that while the announcement was made, the system isn’t fully capable of automatically processing installment applications. According to the March announcement, if your income tax payable is over RM300 and you wish to apply for installments (2 to 6 months), you should be able to log in to MyTax > e-Ansuran and fill in your details. However, several of my students have reported issues, and I’ve experienced the same problem myself.

The officer then advised me that we still need to apply using the traditional methods:

- Method 1: Click “Hubungi Kami LHDN” > “Hantar kepada kami” > “Borang Maklum Balas” > “e-service/ tax” > “eLejer” > Next > Fill in details (Wait for approval, usually very slow).

- Method 2: Fill out a form and submit it over the counter (Wait for notification, usually even slower than Method 1).

Conclusion: If you have the funds, it’s best to just pay it off! If any of you have successfully used e-Ansuran, please contact me and share your experience!

5) New Regulations from 2026 State that Single Invoices Over RM10,000 Cannot Be Consolidated. Is This Permitted During the Grace Period?

Answer: Yes, it is! Anything goes during the grace period! You don’t need to apply for the grace period. As long as you submit a Consolidated E-Invoice by the 7th of the following month to account for your total turnover from the previous month, or a Consolidated Self-Billed e-invoice to account for your import/interest expenses/payments to agents/rent paid to individual landlords (total of 9 Self-Billed items), you’re good to go!

Want to learn more? Join my upcoming free online workshops!

🔥 E-Invoice Online Sharing Sessions 🔥

Please note: Due to Zoom’s participant limit, those who register but forget or are late will not be able to join. Please enter the session early on the day of the workshop. Thank you.

For Self-Employed / Freelancers (English Session) June 17th, 9:00 AM – 12:00 PM [Register now]

自雇人士 (Mandarin Session) June 17th, 1:00 PM – 4:00 PM [报名链接]

门市商家 (Mandarin Session) June 20th, 10:00 AM – 12:00 PM [报名链接]

For Retailers (English Session) June 20th, 2:00 PM – 4:00 PM [Register]

For Construction (English Session) June 23rd, 2:00 PM – 4:00 PM [Register]

建筑业 (Mandarin Session) June 25th, 8:00 PM – 10:00 PM [报名链接]

#AnnieWong #annieway96 #黄如金 #EmploymentContract #老板必懂税税平安

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Annie Wong 黄如金

Annie is a passionate trainer who was inspired by her idol to teach what she learned and to give what she earned. She has more than 10 years of experience in the field of training and SME business consulting.

She graduated with a Bachelor in Science from Campbell University Summa cum laude (First Degree Distinction). She was awarded book prizes and Matthew Bailey Prize Award due to her distinguished academic performance. She then pursued her career switch from a Pharmaceutical Regional Manager to a Financial Consultant.

Currently, Annie is an internationally recognized Certified Financial Planner (CFP Professional) cum International Certified Professional Trainer (ICPT, IPMA, UK). She is a CMSRL Financial Planner (Licensed by Securities Commission Malaysia) and has impacted people financially. She is now one of the core trainers in the Certified Financial Coach Program and is the only accredited Color Accounting Trainer, who can train in both English and Mandarin.