YF Foong, Eunive (冯玉芬)

License No.: eCMSRL/C2240/2022

Registered Financial Advisor

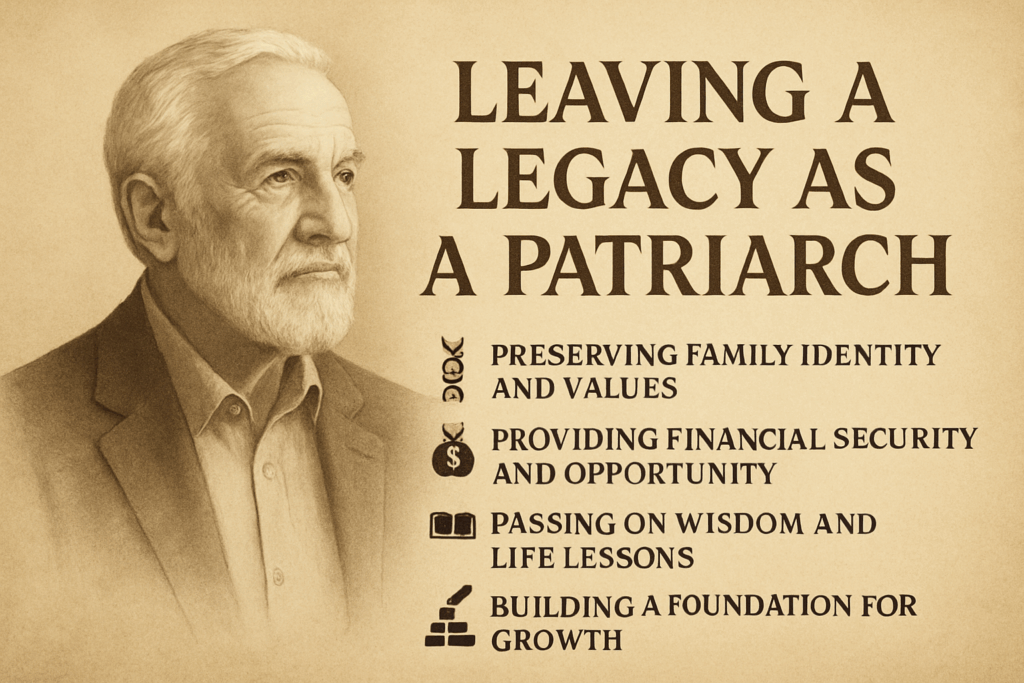

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”

My ultimate goal is to facilitate Financial Freedom for my clients and their families, tailored to every individual time frames and preferences.

My approach is comprehensive and client-focused, emphasizing active listening to understand your concerns and goals.

My aim is to empower every successful business owner with financial access, help them optimize existing funds for growth, protect against personal and business risks, and create sustainable income streams for retirement. My comprehensive approach encompasses:

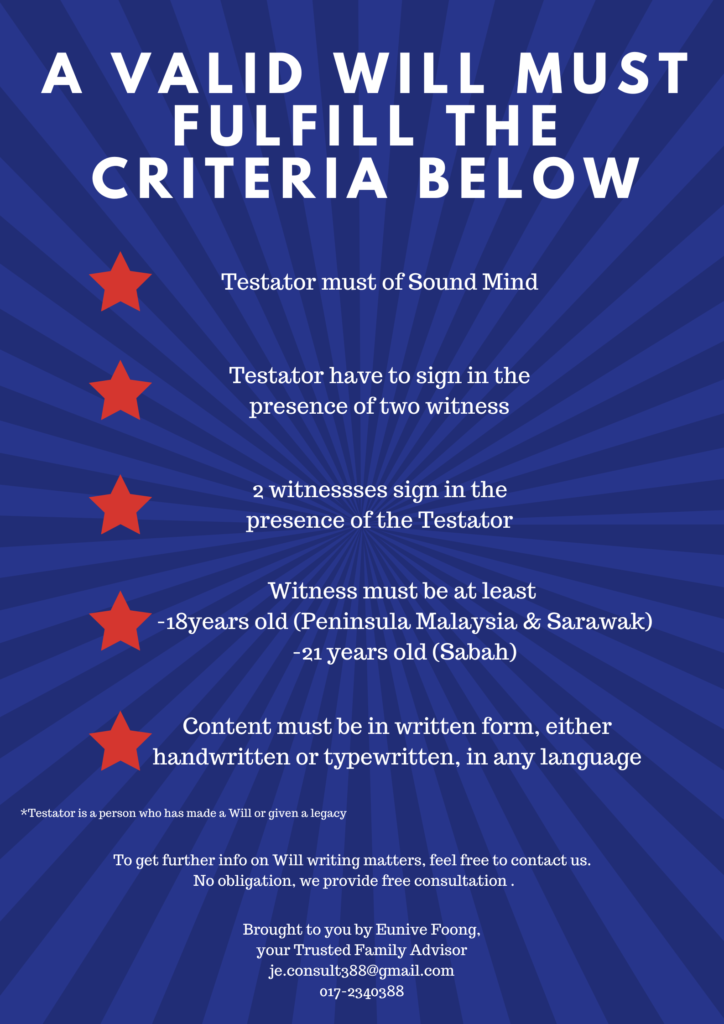

1) Wealth Distribution: Seamlessly transitioning your wealth in a timely and efficient manner.

2) Succession Planning: Identifying and nurturing the right successor for your legacy.

3) Family Office Setup: Establishing structures to safeguard and perpetuate your wealth across generations.

4) Risk Management: Providing peace of mind by mitigating personal and business risks.

5) Golden Years Planning: Crafting a roadmap for a fulfilling and secure retirement.

I bring to the table nine years of dedicated experience in guiding individuals, particularly business owners, through the intricacies of wealth protection and distribution.

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”

My ultimate goal is to facilitate Financial Freedom for my clients and their families, tailored to every individual time frames and preferences.

My approach is comprehensive and client-focused, emphasizing active listening to understand your concerns and goals.

My aim is to empower every successful business owner with financial access, help them optimize existing funds for growth, protect against personal and business risks, and create sustainable income streams for retirement. My comprehensive approach encompasses:

1) Wealth Distribution: Seamlessly transitioning your wealth in a timely and efficient manner.

2) Succession Planning: Identifying and nurturing the right successor for your legacy.

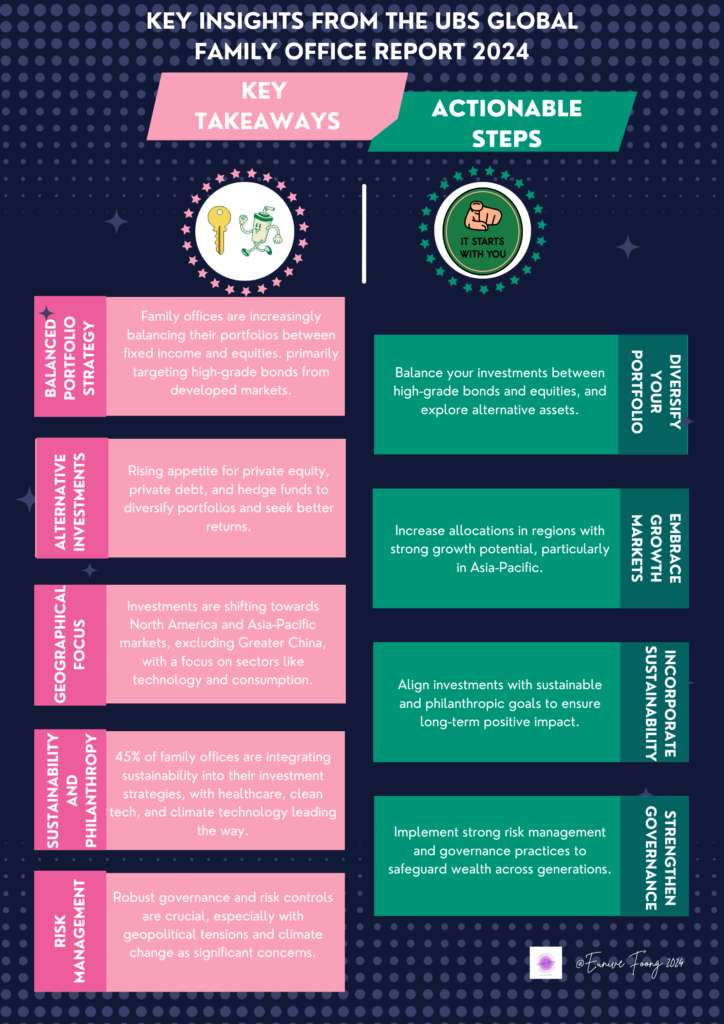

3) Family Office Setup: Establishing structures to safeguard and perpetuate your wealth across generations.

4) Risk Management: Providing peace of mind by mitigating personal and business risks.

5) Golden Years Planning: Crafting a roadmap for a fulfilling and secure retirement.

I bring to the table nine years of dedicated experience in guiding individuals, particularly business owners, through the intricacies of wealth protection and distribution.

My Content

Contact Me

ACKNOWLEDGEMENT

By submitting this form, I confirm that

- I have read and understood FA Advisory Sdn Bhd.’s (FAA) Personal Data Policy, and hereby give my acknowledgement and consent to FAA to use my personal data in accordance with FAA’s Personal Data Policy.

- I have read and understood the disclaimers above and hereby affirm my acceptance of these terms.

- I have not been directly contacted or approached by any representative or employee of FAA with an offer or solicitation to apply for any financial products not offered in my home country.

Scan for Contact Details

Join our newsletter

Subscribe to our newsletter to receive updates on our latest content!