[Step by Step] How to Claim Your Unclaimed Money in Malaysia

KUALA LUMPUR, March 5 — The Accountant-General’s Department (AGD) reported a staggering RM12.7 billion in unclaimed money as of January 31, 2024, according to the Ministry of Finance (MOF).

Back in 2019, the AGD announced plans to develop an online system to help Malaysians check and claim their unclaimed money. Today, this system is fully operational, making the process easier than ever.

What is Unclaimed Money?

Unclaimed money refers to funds or assets that have been abandoned, forgotten, or left inactive for a certain period. This includes:

1. Money Unpaid for at Least 1 Year

- Salaries, bonuses, commissions

- Dividends, profits, or insurance claims

- Expired bank drafts or cashier’s orders

- Matured fixed deposits (without auto-renewal)

- Tender deposits (after fulfilling their purpose)

2. Dormant Accounts (Inactive for 7+ Years)

- Savings accounts

- Current accounts

- Fixed deposits (with auto-renewal)

3. Inactive Trade Accounts (Dormant for 2+ Years)

- Trade creditors/debtors with credit balances

How to Check & Claim Your Unclaimed Money Online

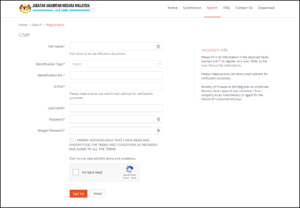

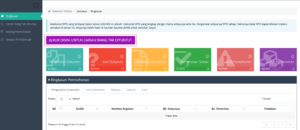

Step 1: Register on eGUMIS

Visit the official eGUMIS portal and click “Registration” to create an account.

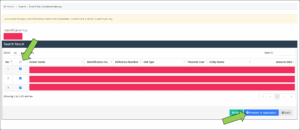

Step 2: Search Using Your IC Number

After logging in, click “Search for Unclaimed Moneys” and enter your IC details. The system will display any unclaimed funds linked to your name.

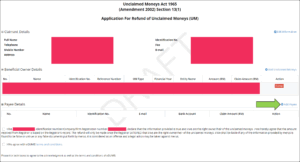

Step 3: Submit a Refund Application

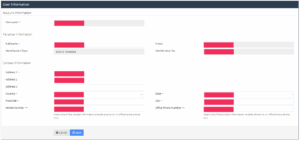

If unclaimed money is found, click “Proceed to Application” and fill in:

- Payee details (your name & bank account info)

- Supporting documents (IC, bank statement, etc.)

Step 4: Upload Required Documents

Prepare and upload:

✅ Copy of IC or passport

✅ Bank statement (for refund processing)

✅ Additional documents (if claiming for a deceased relative)

Step 5: Wait for Approval & Refund

Once submitted, check your application status via eGUMIS. If approved, the refund will be credited to your bank account within 30 days.

Unclaimed Money FAQs

1. How much unclaimed money is there in Malaysia?

As of 2024, the total stands at RM12.7 billion.

2. Who manages unclaimed money in Malaysia?

The Accountant General’s Department (AGD) under the Ministry of Finance.

3. What documents are needed to claim?

- IC/passport copy

- Bank statement

- Proof of ownership (if applicable)

- Legal documents (if claiming for a deceased person)

4. How to avoid eGUMIS scams?

⚠️ Only use the official website: https://egumis.anm.gov.my/

⚠️ Beware of fake websites or phishing attempts.

Conclusion

With billions still unclaimed, you could be sitting on money you didn’t know you had! Follow these simple steps to check and claim yours today.

🔗 Start your claim now: https://egumis.anm.gov.my/

Have you checked for unclaimed money? Share your experience in the comments!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Jacky Tan 陈奕綸

As a Chartered Wealth Advisor and Licensed Financial Planner regulated by Bank Negara Malaysia (BNM) and the Securities Commission (SC), I provide sophisticated financial strategy to high-net-worth individuals, families, and corporations.

With over 16 years of experience, my practice is dedicated to managing the complete life cycle of wealth. I architect tailored solutions that address the complex challenges of:

Wealth Accumulation: Deploying advanced money market strategies and high-yield investment portfolios to accelerate capital growth.

Wealth Preservation: Implementing robust corporate and personal risk management frameworks, including bespoke insurance structuring, to protect assets.

Wealth Distribution: Designing strategic plans for efficient legacy and succession planning, ensuring your wealth fulfills your long-term vision.

I currently advise on over RM300 million in Assets Under Advisory (AUA), leveraging a holistic approach that integrates capital market access, corporate insurance solutions, and talent-centric benefit programs to build financial resilience and drive sustainable growth for my clients.

I am committed to delivering institutional-grade advisory services to private clients.

You’re welcome to contact me – [Click to Connect]