High net worth individuals must avoid being a HENRY

- Cheah Yee Nin

- Wealth Accumulation, Wealth Enhancement, Wealth Maintenance

ARE you among the group of people with high income yet your savings never grow significantly on an annual basis?

There is a term for this group of consumers – HENRY – which stands for “High Earners (but) Not Rich Yet”. These are people with high income but little savings as they simply cannot amass much wealth.

HENRY is the ‘working rich’ which means that they won’t be as rich if they stop working.

Or they do not see themselves as rich even though they earned above-average income. The frustration for HENRY is that nothing is left in their savings after paying off taxes, children’s tuition fees, family living costs and loans (properties and cars).

Although they make a good income, they do not feel they are going ahead in life and cannot escape the rat race.

The common characteristics of HENRY include:

-

- High income: Family annual income range from RM250,000 to RM500,000 (or more).

-

- Profession: Hold upper-level management or executive roles or work as a professional. They are highly educated and have promising careers.

-

- Little to no savings: Despite earning high incomes, their savings are insignificant. Sometimes they may even be short of money.

-

- Feeling of not being rich: They do not feel wealthy despite their high income. They work potentially long hours; once they stop working, they do not have income-generating assets to sustain their lifestyle.

A general case of HENRY

Both husband and wife are in their early 40s. The wife works in a multinational (MNC) while the husband started his private practice two years back. They have two children and both study in international schools.

Both are high-income earners but occasionally experience negative cash flow after upgrading to a bigger residential house and luxury cars.

Since their parents are ageing, they would like their parents to stay with them permanently. Aside from loans and children’s school fees, they do not know where their money has gone to or are unable t0 amass wealth as they desire.

They do not know where their finances will be heading. Hence, they seek advice to improve their financial situation.

Below are the key financial details to illustrate the common pitfall of HENRY. The case illustration aims to provide a big picture instead of focusing on the analysis details.

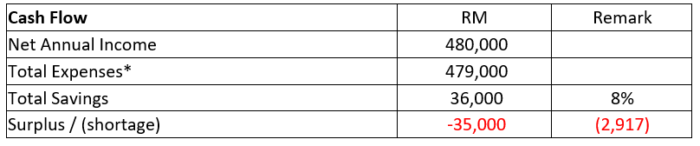

Cash flow statement

The cash flow statement allows us to identify our source of income and how we spend money. It enables us to meet our financial obligations and plan for the future.

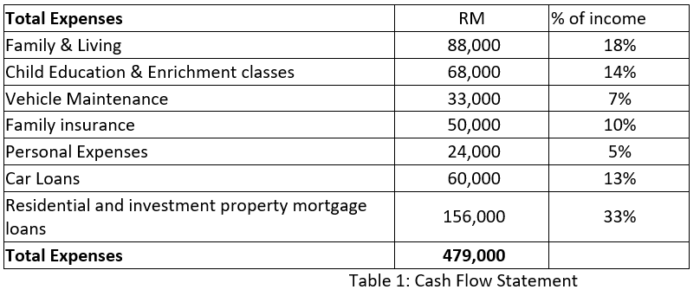

Breakdown of total expenses

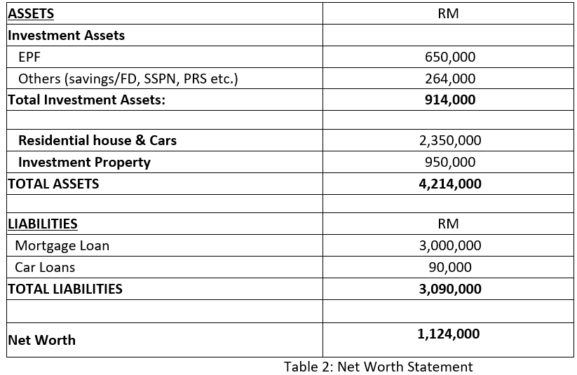

Net worth statement

The net worth statement measures our financial position at a specific time and provides a benchmark from which we can measure our progress.

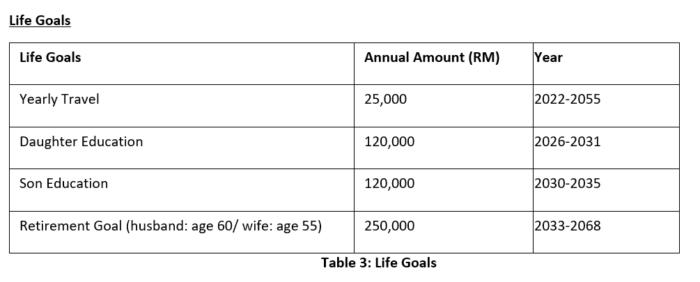

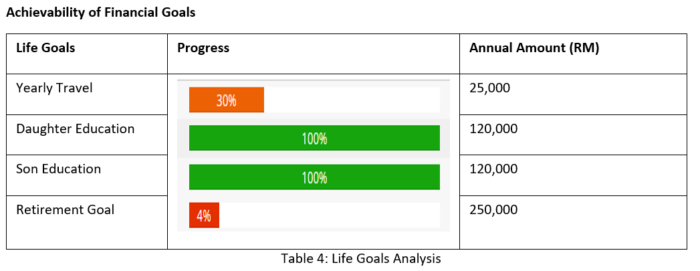

Life goals

Life goals analysis

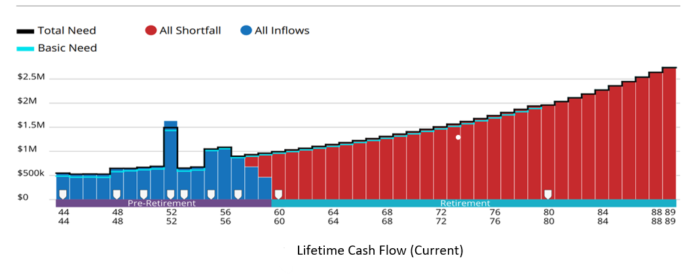

The above graph illustrates the cash flow over their lifetime if the couple maintains their financial behaviours. There is a projected capital shortfall of circa RM8,900,000. The shortfall means they would require this additional money in the bank today to meet all their goals.

The couple can fulfil the children’s dream to study abroad by utilising the proceeds from selling their investment property and EPF (Employees Provident Fund) money. However, there is nothing left for retirement while they must also reduce their holiday expenses.

The outlook of their financial future is unfavourable. The couple must review their current financial behaviours and adjust their financial goals seriously. Some steps taken are:

-

- Reduce unnecessary expenses, create more savings

A healthy cash flow is crucial. It simply means do not spend more than we earn and have substantial savings to accumulate income-generating wealth.

From Table 1, the family experience an insignificant shortage of around RM3,000 per month on average. They currently manage the shortfall by using credit card or their savings.

From Table 2, 70% of the expenses are fixed commitments (ie loans, child’s education, insurance). They only have a 30% buffer to reduce the expenses.

The couple is willing to reduce living costs by cooking more often, cutting their holiday budget, reducing entertainment expenses and dining out. They can save up to RM24,000 annually if they control their cash flow well.

Since the husband is a self-employed medical doctor, he needs to work harder by earning more money to fund all his family goals.

-

- Reduce financial goals

The couple must prioritise the financial goals according to importance.

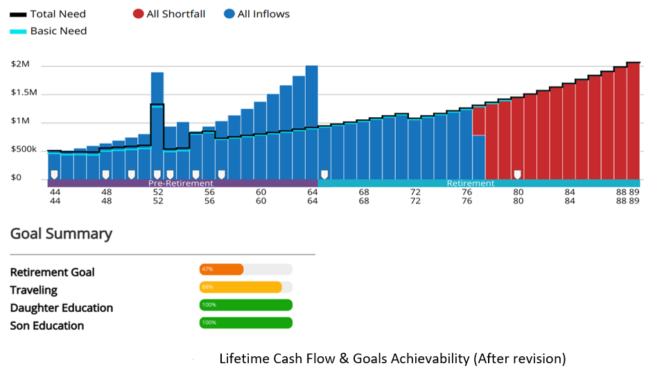

They agree to reduce holidays to RM12,000 per year or delay the overseas holiday to save up more for their children’s education and to accumulate their retirement assets.

For their children’s tertiary education, they may consider local twinning instead of an entire overseas programme. If the children can obtain half or full scholarships, this will significantly reduce their financial needs.

-

- Reduce retirement expenses

As for retirement goals, they have no choice but to extend their retirement age and reduce lifestyle spending.

They are willing to reduce the expenses to RM15,000/month based on today’s value and extend another five years of working life.

-

- Invest wisely

The couple has not invested their money with most of their money still sitting in EPF and FD (fixed deposit)/savings. The couple needs to consider putting aside emergency funding which covers two to three months of expenses while the balance can be put into an efficient investment portfolio.

After revising the plan based on the actions that the couple has agreed on, their lifetime cash flow has significantly improved. However, a yearly review is needed to determine whether their financial goals are realistically achievable given the present circumstances and whether any adjustments are required.

Summary

The client has made a significant financial decision by committing to an expensive residential house and luxury cars too much and too soon. The availability of loans and promotions bundle have pushed them to over-commit on big-ticket items.

There is nothing wrong with that as we must enjoy the fruit of our labour. However, over-commitment to personal asset debts (cars or residential houses) can put us into financial difficulties or limit our resources to realise other financial goals.

Cash flow is the mother of financial planning. We must ensure we have healthy cash flow by having substantial savings and not letting all our money go into expenses. What is left to build income-generating assets if we over-commit to personal-used debts too much and too soon?

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Cheah Yee Nin

❓ You want to retire early…but not too early, only to discover money runs out too soon.

😖 You don’t want to retire too late…end up working when you could have been playing.

💥 Or you already retire…but constantly worrying about money and how long can it last?

This is a common dilemma. Most people don’t know their NUMBERS – how much money they need for the rest of their life. They may have properties, savings, investments, insurance etc., but no clue what it means and how they are heading financially.

So, what is your NUMBER? Not just to survive but live your life to the fullest. Knowing how much money is ENOUGH will give you the freedom to live your life happier. With much clarity, you know what kind of life you want, how much you need and maintain it for the rest of your life. It’s true liberation! After all, life is not a rehearsal; we must live the life we truly enjoy.

Here’s where I come in. I practice Lifestyle Financial Planning. I will assist you in achieving your desired life through a proven and systematic financial planning process. The future will come whether you plan for it or not. Let’s warm up via an enjoyable 30 mins complimentary exploratory discussion HERE.