How to plan ahead for your special child

Child is a parent’s most valuable asset. We always want to give them the best of what we have. For those parents with special kids, besides giving our best, they also need certain guidance, care and special attention. How should we plan for them if we are unable to hold their hands all the way and force to say goodbye forever?

What are parents concerned about ?

- Who will take care of our special children ?

- Will our special child be well taken care of?

- How should we plan for their inheritance?

- How should we protect our special child?

All of the above concerns should be map out precisely in a Will to ensure their well being fully protected. In a Will, we should appoint a guardian or a caretaker to take over the parents role of taking care of the special child.

What are the main criteria a parent should take into consideration while appointing a guardian or a caretaker ?

- Lifestyle and environment – What kind of lifestyle the appointed guardian currently has ? Can this special kids fit into the current lifestyle? Is the living environment of the guardian suitable for the special child? What’s their family belief ?

- Life stability – do they need to take care of their own kids as well? Do they have a busy working life?

- Time availability – Do they have time to take care of my special child ?

- Financial stability – Do they have a full time job ? Are they able to manage their finances soundly?

How should a parent plan for the special child ?

Some parents think they would like to disinherit the child and place the responsibility on their brothers or sisters to take care of the special child ? On the other hand, parents worry that the siblings would not be able to continue taking care of them once they have their own family or due to other unforeseen circumstances. Hence, it is important to make a plan for the special child and do not solely rely on their siblings.

First, set up a Will. Extend your Will planning to a testamentary trust. Since it is not wiseable to let the special child inherit any assets, let the trustee hold on to the estates and plan to distribute to the special child as at when he/she needs it.

Categorize your assets into movable assets and immovable assets. Movable assets means assets that are liquid and able to financially support the special child. They need to be supported for their monthly maintenance, medical & health related matters and education.

Besides, provide a safe haven for the special child. If the special child inherits the property straight away without holding into trust, they may be at risk of being cheated by those who have interest in the property. Holding it in trust to enable the special child to have a place to stay during their lifetime. You can always set a substitute beneficiary on the property, shall the first beneficiary no longer be around.

Who should be appointed to carry out the instruction ?

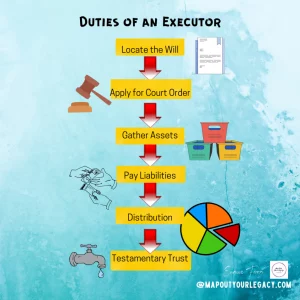

Choosing the right person to act or what we call an executor is vital because this is a lifelong process. Make sure the executor is trustworthy, have the required skills and knowledge to carry out the distribution and instruction, able to outlive the beneficiary and have the time to manage all the required duties.

Nevertheless, a complete Will or estate planning shall not stop there forever. Review your planning every 3 to 5 years to make sure it is still spell out your initial intention. If your intention changed or differ, please update your Will accordingly.

Lastly, keep your Will safely in a place where your beneficiary is able to locate it. Or else, a written Will would be as good as no Will at all if there is no one able to locate it.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

YF Foong, Eunive (冯玉芬)

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”