Preserving Wealth in a Dynamic Market: Key Insights from the UBS Global Family Office Report 2024

As we navigate the ever-evolving financial landscape, the preservation and growth of wealth remain paramount. The recent UBS Global Family Office Report 2024 offers invaluable insights that highlight strategic shifts and emerging trends among Asia-Pacific family offices, providing a blueprint for effective wealth management.

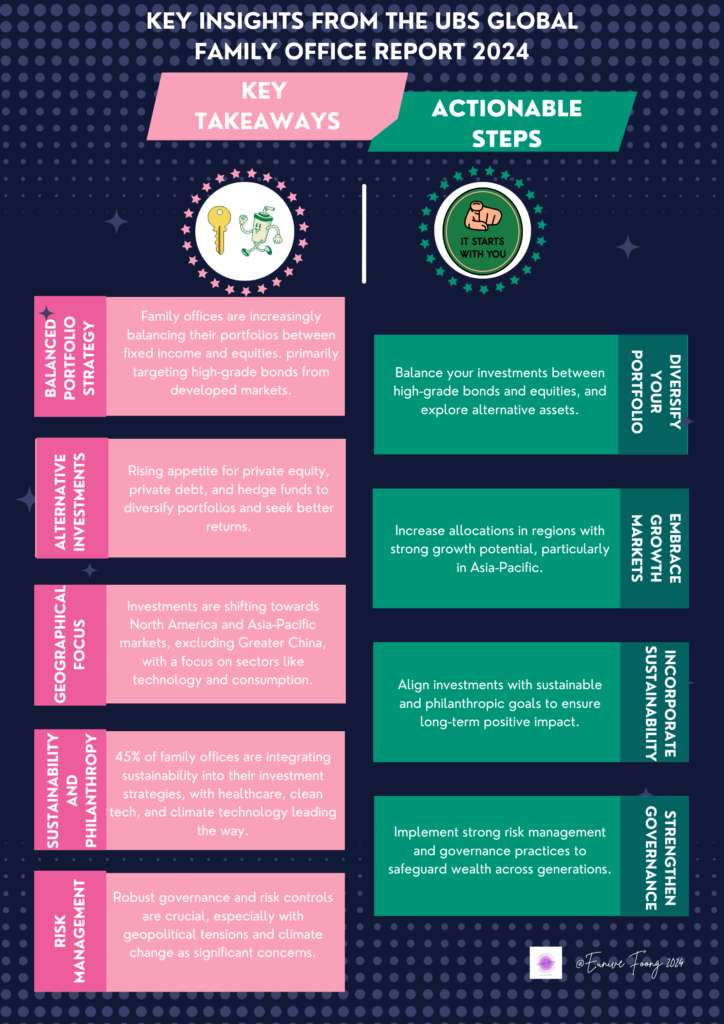

Key Takeaways:

- Balanced Portfolio Strategy: Family offices are increasingly balancing their portfolios between fixed income and equities. In 2023, fixed-income allocations soared to 25%, up from 15% in 2022, primarily targeting high-grade bonds from developed markets.

- Alternative Investments: There’s a notable increase in allocations to private equity, private debt, and hedge funds, aiming for diversification and enhanced returns.

- Geographical Focus: Investments are shifting towards North America and Asia-Pacific markets, excluding Greater China, with a focus on sectors like technology and consumption.

- Sustainability and Philanthropy: 45% of family offices are integrating sustainability into their investment strategies, with healthcare, clean tech, and climate technology leading the way.

- Risk Management: Robust governance and risk controls are crucial, especially with geopolitical tensions and climate change as significant concerns.

Actionable Steps:

- Diversify Your Portfolio: Balance your investments between high-grade bonds and equities, and explore alternative assets.

- Embrace Growth Markets: Increase allocations in regions with strong growth potential, particularly in Asia-Pacific.

- Incorporate Sustainability: Align investments with sustainable and philanthropic goals to ensure long-term positive impact.

- Strengthen Governance: Implement strong risk management and governance practices to safeguard wealth across generations.

By adopting these strategies, we can not only preserve wealth but also position ourselves for sustainable growth in the years to come. Let’s stay proactive and informed to navigate the complexities of wealth management effectively.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

YF Foong, Eunive (冯玉芬)

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”