Wealth Transfer Made Easy: Navigating Inheritance and Estate Taxes

What is an inheritance tax?

Inheritance tax is a tax imposed by the government on the value of inherited assets, paid by the beneficiary of the inheritance. Simply put, the person receiving the asset or estate must pay this tax before they can inherit the estate.

What is an estate tax?

Estate tax is levied on the value of the deceased’s estate, and the estate itself is responsible for paying it.

The Main Difference Between Inheritance and Estate Tax:

The primary difference is WHO PAYS THE BILL. For inheritance tax, the beneficiary pays the tax. For estate tax, the estate of the deceased pays the tax before distribution to the heirs.

Has Malaysia ever had such taxes?

Yes, previously the Estate Duty Enactment 1941 imposed estate duty on deceased estates. Initially, there were 28 tax brackets with rates ranging from 0% to 40%, applicable to estates valued above RM5 million. After several reforms, from 1984, only three brackets remained: 0% for estates valued less than RM2 million, 5% for estates above RM2 million, and 10% for estates above RM4 million. This estate duty act was repealed effective from November 1, 1991.

When did the discussion about inheritance tax resurface?

In September 2017, during the Budget 2018 discussions, the topic of inheritance tax resurfaced.

Inheritance Tax Worldwide:

Inheritance tax is commonly found in developed nations. Among the Organisation for Economic Co-operation and Development (OECD) countries, Japan has the highest rate at 55%, followed by South Korea at 50%, the US at 40%, and the lowest rate of 4% in Italy. See the table below for a comparison:

By understanding the differences between these taxes and their implications, individuals can better plan their estates to minimize tax burdens and ensure smooth transfers of wealth to their beneficiaries.

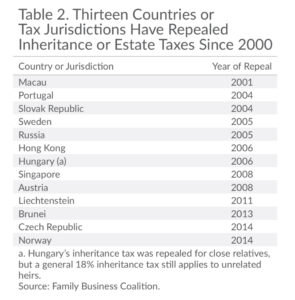

However, eleven countries and two tax jurisdictions have repealed their estate or inheritance taxes since the year 2000. Refer table below.

In nations that impose an inheritance tax, estate planning often focuses on minimizing the tax burden for beneficiaries. Here are some common strategies and elements of estate planning in these countries:

Key Strategies

- Gifting During Lifetime

Gifting assets during your lifetime can be an effective way to reduce the value of your estate and, consequently, the amount of inheritance tax your beneficiaries will have to pay. Here are some ways to do this:

- Annual Gift Exemptions: Many countries allow individuals to give away a certain amount of money or assets each year without incurring gift tax. For example, in the UK, you can give up to £3,000 per year tax-free, and this amount is not counted towards the value of your estate.

- Lifetime Gifts: In some jurisdictions, gifts made during your lifetime can be exempt from inheritance tax if the donor survives for a specific period (e.g., seven years in the UK). This is known as the “seven-year rule.”

- Special Exemptions: Certain types of gifts, such as those for weddings or to help children with education or living costs, may have additional exemptions.

- Use of Trusts

Trusts are versatile tools that can help manage and protect your assets while potentially reducing inheritance tax:

- Irrevocable Trusts: By transferring assets into an irrevocable trust, you effectively remove them from your estate, which can reduce the inheritance tax liability. The trust then holds and manages these assets according to the terms set out when it was created.

- Life Insurance Trusts: A life insurance trust owns your life insurance policy, ensuring that the death benefit is not included in your taxable estate. This provides liquidity to pay any estate or inheritance taxes without having to sell off other assets.

- Charitable Donations

Charitable donations can play a significant role in estate planning, offering tax benefits while supporting causes you care about:

- Charitable Trusts: Establishing a charitable trust allows you to donate assets while still retaining some benefits during your lifetime. For example, a charitable remainder trust provides you or other beneficiaries with income for a set period, after which the remaining assets go to charity.

- Direct Bequests: Leaving a portion of your estate directly to charitable organizations can reduce the taxable value of your estate, as these bequests are typically exempt from inheritance tax.

Common Tools and Techniques

- Life Insurance

Life insurance is a critical component of estate planning, providing a financial safety net for your beneficiaries:

- Liquidity for Taxes: The death benefit from a life insurance policy can provide immediate funds to pay inheritance taxes, ensuring that your heirs do not have to sell off assets to cover the tax bill.

- Trust-Owned Policies: Placing your life insurance policy in a trust can keep the proceeds out of your taxable estate, further reducing the inheritance tax burden.

- Family Foundations

Family foundations are excellent tools for managing and preserving wealth across generations while also benefiting from favorable tax treatment:

- Philanthropy: Establishing a family foundation allows you to support charitable causes over the long term, reflecting your family’s values and legacy.

- Tax Advantages: Contributions to a family foundation can provide immediate tax deductions, and the assets within the foundation can grow tax-free, reducing the overall tax liability.

- Pension and Retirement Accounts

Strategically using pension and retirement accounts can optimize tax efficiency and ensure a smooth transfer of wealth:

- Tax-Deferred Growth: Contributions to pension and retirement accounts often grow tax-deferred, meaning you do not pay taxes on the growth until you withdraw the funds.

- Beneficiary Designations: Properly designating beneficiaries for your pension and retirement accounts ensures that these assets transfer directly to your heirs, often with favorable tax treatment compared to other types of assets.

By understanding the distinctions between inheritance tax, which is paid by the beneficiary, and estate tax, paid by the estate, individuals can strategically plan to minimize tax burdens and ensure efficient wealth transfer. In Malaysia, while there is no current inheritance tax, historical context and global practices underscore the importance of effective estate planning. Strategies such as gifting during one’s lifetime, utilizing trusts, and making charitable donations, along with tools like life insurance, family foundations, and pension accounts, are essential for preserving wealth and providing for beneficiaries. These approaches not only protect assets but also align with legal requirements, ensuring a smooth and tax-efficient transition of wealth.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

YF Foong, Eunive (冯玉芬)

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”