Ticking Through Time: What Family Businesses Can Learn from a 270-Year-Old Watchmaker

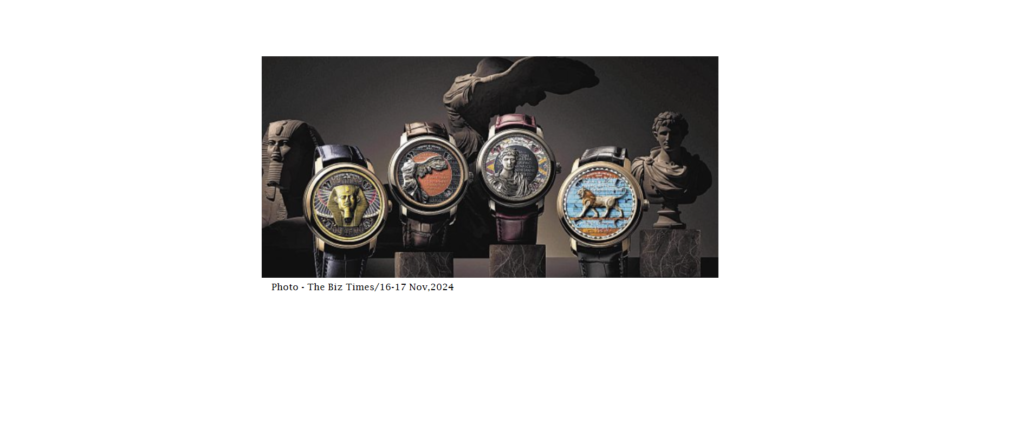

Running a family business is a lot like winding a vintage watch—you need the right mix of precision, patience, and a bit of faith that the gears will keep turning long after you’ve handed it down. Enter Vacheron Constantin, the world’s oldest watchmaker in continuous operation, with a history spanning 270 years. What’s their secret? And more importantly, how can your family business tick just as steadily across generations?

Spoiler alert: It’s not just about having a Swiss address or a fancy logo. It’s about strategy, shared values, and a little thing we like to call timeless governance.

1. Mastering Craftsmanship: Build a Legacy, Not Just a Product

When Vacheron Constantin began in 1755, their focus wasn’t just making watches—it was about making the best watches. Over centuries, they’ve stayed true to their core mission: craftsmanship, innovation, and quality.

Family businesses, take note: Whether you’re crafting artisan bread or running a tech empire, a commitment to excellence and innovation is what keeps the legacy alive. Don’t just think about what’s trending this decade—think about what will still matter in the next century.

Pro Tip: Define your family business’s unique value. Are you the “fine watchmaker” of your industry? If not, what’s stopping you?

Humor Note: And no, “Being the least annoying sibling” doesn’t count as a value proposition!

2. Family Governance: Avoid Turning Boardrooms into Boxing Rings

Vacheron Constantin is still thriving because it prioritizes structure. Behind its elegant timepieces is a framework of discipline—strategic planning, innovation, and (yes) external advisors.

Family businesses, on the other hand, often run the risk of turning the dining table into a WWE ring during decision-making. That’s why a Family Constitution or governance system is your best ally.

Takeaways:

- Set clear roles and boundaries for family members.

- Create councils or advisory boards to keep personal drama out of professional decisions.

- Agree on a shared vision, and revisit it regularly—just like servicing a fine watch.

Humor Note: Uncle Bob and Aunt Sally debating over office parking spots? That’s not a governance model.

3. Succession Planning: Groom the Next Generation, Don’t Assume It

Vacheron Constantin didn’t survive 270 years by handing the reins to the first heir who said, “I like shiny things!” They prepared their successors, ensured they had the right skills, and let the brand evolve with fresh perspectives.

For family businesses, succession planning should start early. Identify potential leaders, expose them to different roles, and give them room to grow. Sometimes, it’s okay to look outside the family for professional managers too.

Questions to Ask:

- Is the next generation interested and capable?

- Are they ready to learn or just waiting to inherit?

- Are you comfortable hiring external professionals if the family bench runs thin?

Humor Note: Remember, leaving your empire to someone whose greatest achievement is “reaching Level 200 in Candy Crush” might not be the best strategy.

4. Preserve Wealth Like You Preserve Memories

A watchmaker’s secret? Meticulous attention to detail. Each piece is built to withstand time—not just for looks, but for performance. The same applies to wealth preservation in family businesses.

Practical Tools for Wealth Management:

- Trusts: Ensure assets are distributed fairly and protected from disputes.

- Foundations: Create a lasting legacy through philanthropy or reinvestments.

- Family Constitutions: Document rules for wealth distribution and business decisions.

Humor Note: A Constitution doesn’t have to be as long as “War and Peace.” But it should be more substantial than “Don’t touch Dad’s favorite golf set.”

5. Stay Relevant but Stay Authentic

One reason Vacheron Constantin thrives is its balance of tradition and innovation. They embrace modern technology but never compromise their identity.

Family businesses can follow suit:

- Adopt new tools and processes to stay competitive.

- Never lose sight of the values that define your brand.

Example: A family bakery that’s been around for decades can introduce gluten-free options without ditching grandma’s famous chocolate cake recipe.

Humor Note: Just don’t slap the family crest on an app and call it innovation.

Closing Thoughts: Timeless Lessons for Timeless Success

Much like a fine watch, a family business’s success is in the details. It’s in building a shared vision, embracing governance, and preparing the next generation to take the helm. Vacheron Constantin’s story reminds us that longevity isn’t an accident—it’s a choice.

So, the next time you glance at a watch, think about your family business. Is it running smoothly, or does it need a tune-up? And if you’re ever tempted to let a little dysfunction slide, remember: Even the finest timepiece needs regular servicing to stay timeless.

Humor Note: After all, you wouldn’t want your family legacy to stop ticking, would you?

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

YF Foong, Eunive (冯玉芬)

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”