Lesson learned from real succession planning stories and what’s your takeaway

As a business owner, your hard work and dedication have built something extraordinary. Ensure that your legacy endures and your business thrives for generations to come.

Let’s dive into an article discusses an internal family dispute at NagaCorp Ltd, a major casino operator in Phnom Penh, Cambodia.

The conflict is between two of the heirs of the late Dr. Chen Lip Keong, a Malaysian billionaire and founder of NagaCorp.

The board of directors of NagaCorp has decided to restructure the management and governance to address the growing tensions and to ensure the company’s effective operation.

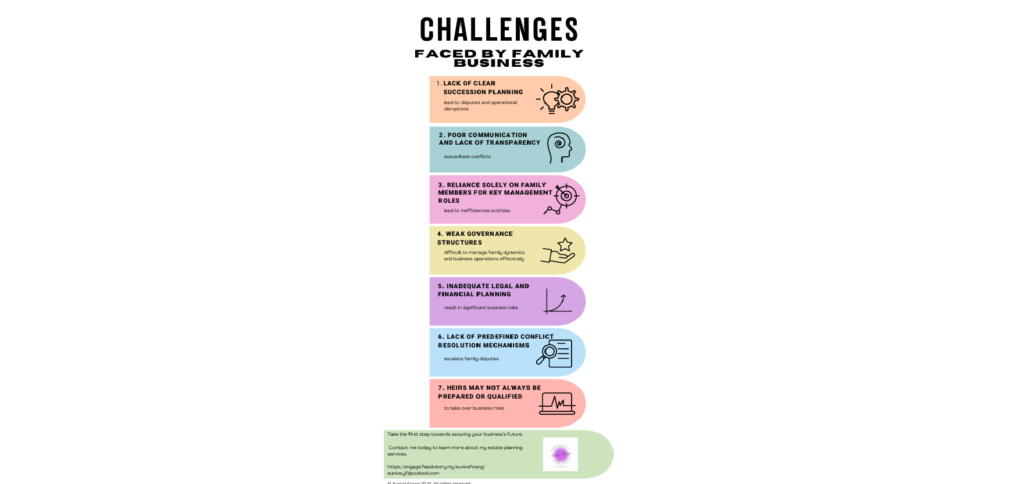

The NagaCorp family feud highlights several critical aspects of estate planning, particularly for family-owned businesses. Here are key learning points that you can find in the attached infographic.

By learning from the challenges faced by NagaCorp, families can implement more robust estate planning strategies that ensure the smooth transition of assets and management roles, thereby preserving family harmony and business continuity.

I specialize in estate planning for business owner. I offer clear succession strategies, conflict resolution mechanisms and professional tailored specifically for family-owned businesses.

Let me help you create a seamless transition plan, safeguarding your family’s future and your business’s success.

Partner with me to protect what matters most.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

YF Foong, Eunive (冯玉芬)

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”