The Exclusive Club: What It Means to Be an Accredited Investor

Imagine being handed the keys to a secret club where investment opportunities flow like champagne and the air is thick with the scent of potential profits. Welcome to the world of accredited investors, where financial sophistication is the entry ticket, and the benefits are as enticing as a Warren Buffett quote at a shareholder meeting.

Who’s Invited to the Party?

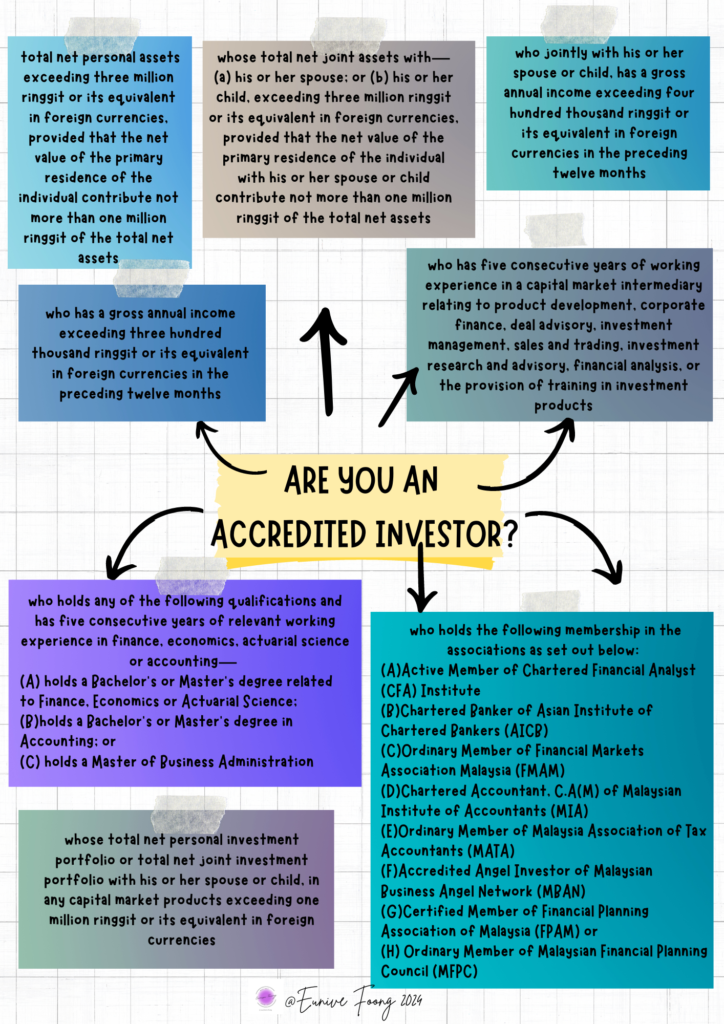

To join this elite club, you need to meet certain financial criteria laid out by the SEC. It’s like being invited to the Met Gala, but instead of fashion, it’s your balance sheet that needs to impress.

- For Individuals:

- Income: You need an annual income north of RM300,000 or its equivalent in foreign currencies in the preceding twelve

months (or RM400,000 if you’re flaunting a power couple status). Think of it as having a golden ticket that gets validated annually. - Net Personal Assets: You need total net personal assets exceeding three million ringgit (or its equivalent in other currencies). However, the net value of your primary residence can’t contribute more than one million ringgit to this total. In other words, you’re sitting on a cool million in assets, like Scrooge McDuck but with less swimming and more spreadsheets.

- Income: You need an annual income north of RM300,000 or its equivalent in foreign currencies in the preceding twelve

- For Entities:

- Assets: Your business needs to have assets totaling over RM10 million. That’s a lot of zeroes, folks.

Perks of the Elite Status

Being an accredited investor isn’t just about the bragging rights. It comes with some sweet perks that the average Joe (or Jane) on Main Street can only dream of.

- Access to Private Offerings:

- Accredited investors can dive into private placements, hedge funds, venture capital, and other unregistered securities. These aren’t your garden-variety stocks and bonds; these are the backstage passes to the financial rock concerts.

- Early Investment in Startups:

- Remember those startups that you read about and think, “Why didn’t I invest in that?” Well, accredited investors get to be the early birds catching those juicy worms. Think Uber before it was Uber or Facebook in the dorm room days.

- Diversification:

- It’s like having a multi-course meal instead of just the entree. Accredited investors can spread their wealth across a smorgasbord of alternative assets like real estate, commodities, and more. As the old saying goes, “Don’t put all your eggs in one basket” – a proverb cherished by both grandmas and investors alike.

- Reduced Regulation:

- The red tape is thinner here. Less regulation means faster access to investment opportunities and lower compliance costs. It’s like having the TSA PreCheck of the financial world.

- Potential for Higher Returns:

- Higher risks can mean higher rewards. Accredited investors often get the first crack at opportunities designed to generate significant returns. As Warren Buffett wisely put it, “Risk comes from not knowing what you’re doing.” Accredited investors are expected to know exactly what they’re diving into.

The Fine Print: Risks and Responsibilities

With great power comes great responsibility – and higher risks. These investments are less regulated and less liquid, meaning you can’t always cash out quickly. They’re also more complex, often requiring a deep dive into due diligence. Accredited investors need to channel their inner Sherlock Holmes to navigate these waters.

So, while the doors to this exclusive club swing wide open for accredited investors, they must tread carefully. The potential for profit is significant, but so is the risk. As the Oracle of Omaha himself might advise, “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.” In the world of accredited investing, surrounding yourself with wise counsel is key.

In conclusion, being an accredited investor is like being handed the keys to a treasure chest, but it’s up to you to ensure it’s not filled with fool’s gold. Happy investing, and may your portfolio be ever in your favor.

For more information on Definition of Accredited Investor, kindly refer: download.ashx (sc.com.my)

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

YF Foong, Eunive (冯玉芬)

“As a dedicated financial advisor, my passion lies in collaborating with individuals, particularly business owners, to safeguard their hard-earned wealth. My primary goal is to ensure that the wealth you diligently accumulate throughout your lifetime is securely protected, smoothly transferred, and effectively preserved for your chosen heirs in a fast, seamless, and reliable manner.

Wealth distribution planning is deeply personal, with each individual harboring unique desires and concerns. I pride myself on being a attentive listener, eager to understand your innermost worries and aspirations. Together, we navigate through your thoughts and preferences to chart a tailored roadmap that aligns with your ultimate wishes.

A well-defined wealth distribution roadmap not only provides clarity but also shields you from unexpected distractions along life’s journey. With this roadmap in hand, you can confidently pursue further wealth accumulation, knowing that you’ve established a robust financial safety net.

I invite you to take the next step forward with me on this journey. Let’s connect soon to discuss your financial aspirations and craft a plan that secures your legacy.”