Financial roadmap for future graduates: Start it young!

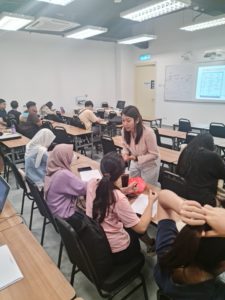

I was invited back by the Financial Planning Association Malaysia (FPAM) to deliver a financial literacy talk to a group of finance students in HELP University Subang Campus.

These young minds have such a promising future, I believe financial literacy is a cornerstone for success.

During the session, we explored:

Understanding Your Money Personality: Through a fun and insightful quiz, students gained valuable self-awareness about their financial habits and preferences.

Building a Strong Financial Roadmap: We discussed practical strategies for budgeting, saving, and making smart financial decisions early on.

Hands-on Budgeting Workshop: Students were guided to create their personalized budgets, putting theory into action.

It warms my heart to be able to connect with them especially on the topic which I am passionate about, reminding myself the reason I am in this industry.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Lynn Say

Spending time as a chartered accountant in the corporate world gave me perspective on the importance of financial planning for a company. Every company I worked with had an accountant or an army of accountants. This led me to wonder: why are there no accountants for your personal finances?

My clients seek my assistance for a comprehensive financial plan or on specific areas of personal finances that they are concerned with. Sometimes, it could just be as simple as understanding and making a comparison between products. My advice helps save time and money, but more importantly, it’s to prevent anyone from making costly errors due to a lack of better judgement. As an independent adviser, I am not tied to any financial institutions, which makes my recommendations impartial.

I put myself in your shoes to understand your perspective and way of life, so I can help plan, identify potential risks, and find the best solution for you.