Samantha Lim 林淑燕

License No.: eCMSRL/B7268/2017

Senior Financial Consultant

Wealth Strategist | Will & Trust Specialist | Passive Income Architect

The True Meaning of Wealth:

For the first half of life, you work for money. For the second half, your money should work for you.

After 30 years in the financial trenches, I’ve realized that most people’s goals boil down to two simple things:

“LIVING WELL NOW” – Having a steady, monthly cash flow that doesn’t depend on market luck or a paycheck, so retirement doesn’t mean “downgrading.”

“NO DRAMA LATER” – Knowing that if you aren’t around to manage things, the money stays safe, the instructions stay clear, and the family stays united.

True wealth management is about building a reliable income engine today and putting a bulletproof shield around it for tomorrow.

TURNING ASSETS INTO “LIFE SUPPORT”: THE 3 PILLARS

BUILDING YOUR PASSIVE INCOME ENGINE: Real retirement isn’t about a lump sum in the bank; it’s about Cash Flow. I help you “wake up” idle assets and restructure them so that no matter how the economy fluctuates, you have a consistent “monthly salary” hitting your account. That is the definition of true financial peace.

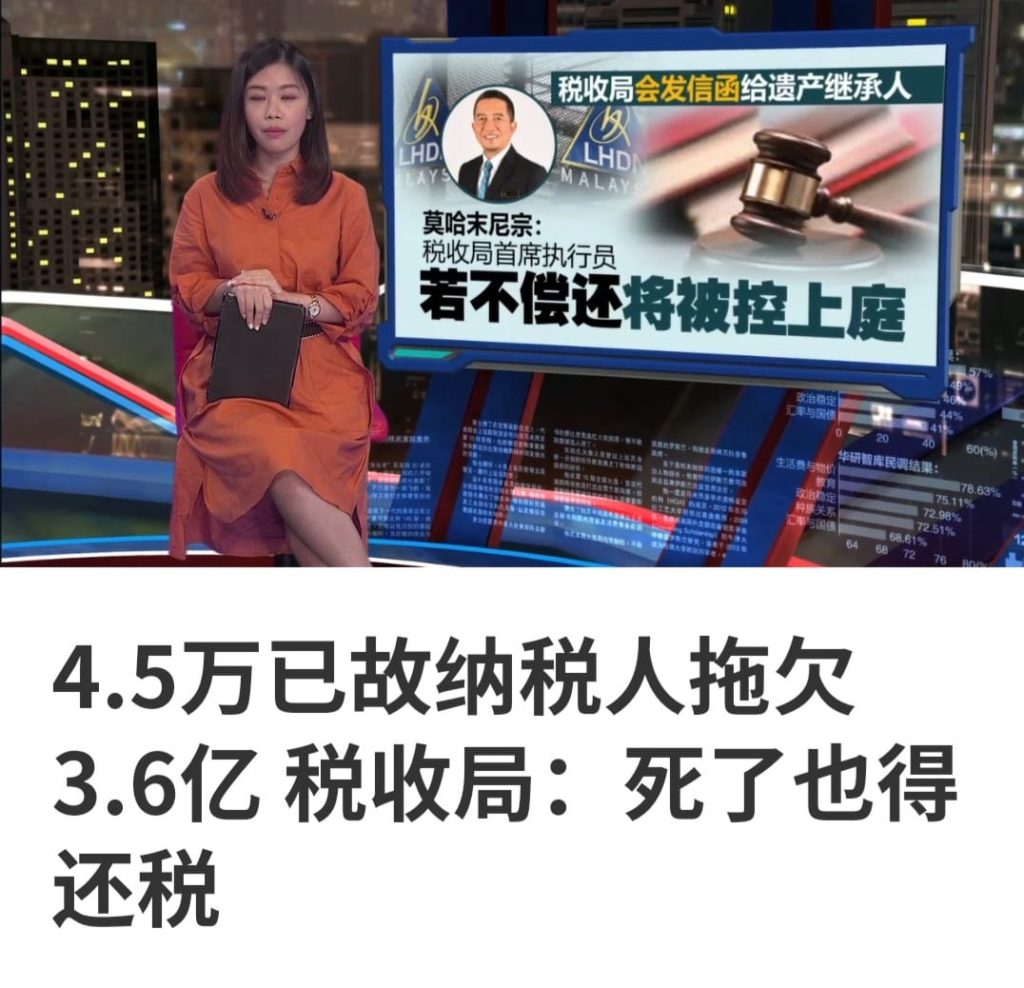

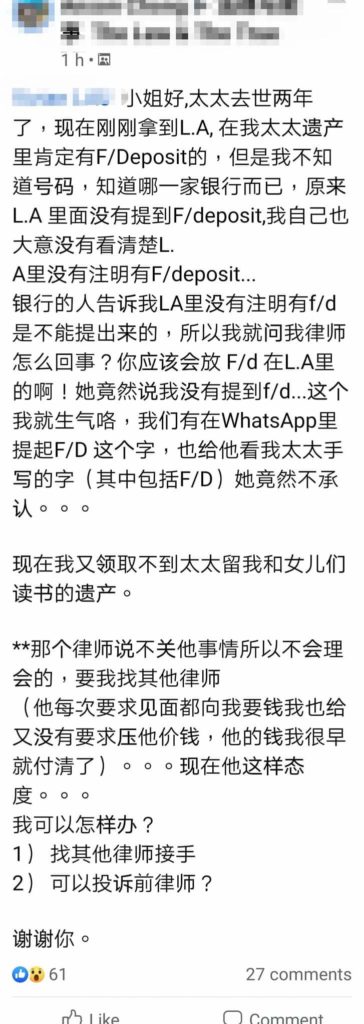

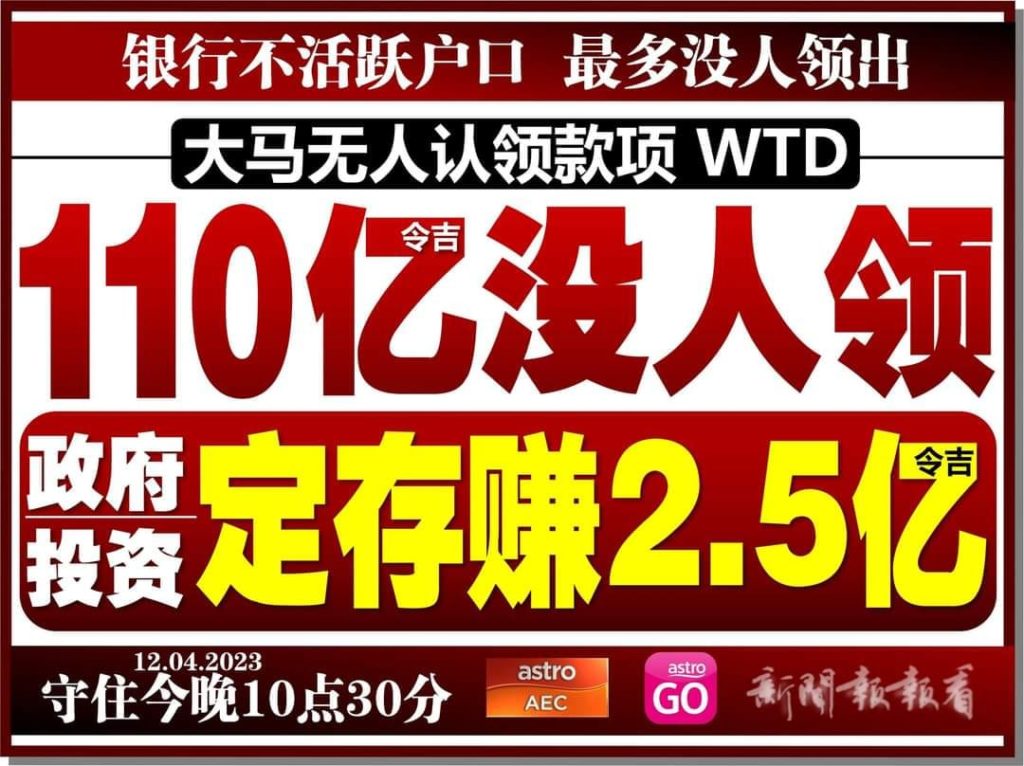

ENSURING MONEY “BEHAVES” AND STAYS PUT: Earning wealth is a skill; keeping it is a strategy. Through Wills and Trusts, we write the “Owner’s Manual” for your money. Whether it’s providing for a spouse or ensuring children receive their inheritance in stages, we make sure every dollar follows your command—not a stranger’s or a court’s.

THE WEALTH FIREWALL: Many business owners have their personal lives and business risks tangled together. We create Risk Isolation. Even if the business faces a storm, your family’s lifestyle remains “all-weather” and untouched.

While YOU are still in the driver’s seat – HOLDING THE STEERING WHEEL, let’s streamline your income for today and pave the road for tomorrow. Life can be spontaneous, but your wealth should be organized.

Click HERE to schedule Peace-of-Mind Conversation with me today!

财富策略师 | 遗嘱与信托专家 | 被动收入架构师

财富的终极意义:前半辈子人赚钱,后半辈子钱养人。

从事金融行业三十年,我发现大家最真实的愿望其实很简单:

一个是**“现在有钱花”——不管行情好不好,每个月都有现金进账,退休生活不降档。

一个是“以后不麻烦”**——万一自己管不动了或者不在了,钱能听话,家不闹腾。

说白了,财富管理就两件事:设计一套源源不断的收入,再给这套收入装一个保护罩。

让资产“活”起来:这三件事是重头戏

打造“被动收入引擎”: 真正的退休不是看存款有多少,而是看现金流有多少。我们会把那些“睡着”的资产叫醒,重新架构,确保无论市场怎么波动,你每个月都有雷打不动的“工资”入账。这叫财务自由的底气。

确保“钱听话,不乱跑”: 赚到钱是本事,留住钱是水平。通过遗嘱和信托,给财富写好“说明书”。不管是想照顾老伴,还是想让孩子细水长流地花钱,都要确保每一分钱都按你的指令走,而不是被外人卷走或被官司耗掉。

给财富装上“防火墙”: 很多老板生意做得大,但家里的钱和公司的账搅在一起。我们要做的就是风险隔离。哪怕外头风大浪大,家里的小日子依然能旱涝保收。

结语:与其为钱奔波,不如让钱为你服务。

所谓的财富规划,其实就是把**“不确定”变成“确定”**。

趁现在看得清、做得了主,把当下的收入流理顺,把未来的传承路铺好。生活可以随性,但财富必须有序。

🧩 Expertise in Action: Real Solutions for Real Lives

I don’t just manage portfolios; I solve the "What Ifs." Here is how I’ve helped others navigate life’s turning points:

1. THE INCOME ARCHITECTS (Retirement & Passive Flow)

- THE "EARLY EXIT": Helped a 50-year-old business owner restructure "stuck" assets into a monthly cash flow, giving him the confidence to retire 5 years early.

- THE PENSION GAP: Assisted a retiree in shifting from high-risk stocks to a stable "Income Engine," ensuring her lifestyle stayed "all-weather" despite market drops.

2. THE LEGACY PROTECTORS (Wills, Trusts & Children)

- THE SINGLE PARENT‘S SAFETY NET: Set up a protective Trust for a divorced mother, ensuring her children’s education and daily needs are funded and a legal guardian is locked in.

- THE "MINOR CHILD" GUARANTEE: Helped new parents move beyond a simple Will by creating an Insurance Trust, ensuring payouts are managed by a professional for their child’s future.

- THE CHILDLESS LEGACY: Guided a single professional in creating a "Generational Love" Trust for her nieces and a charitable foundation to fund scholarships in her name.

3. THE BUSINESS GUARDIANS (Succession & Continuity)

- THE PROBATE SHIELD: Protected a manufacturing firm from frozen bank accounts and creditor demands by moving the company shares into a Succession Trust.

- THE "FAIRNESS" BALANCE: Helped a hardware store owner pass the business to his active son while providing equal "non-business" value to his other children to keep the family happy.

4. THE CRISIS MANAGERS (Dementia, Dispute & Distance)

- THE DEMENTIA DIRECTIVE: Set up a Living Trust for a client that automatically triggers medical funding and care instructions upon a diagnosis of cognitive decline.

- THE "TOUGH LOVE" WILL: Drafted a legally ironclad estate plan for a father wishing to disinherit a child, ensuring his wishes were carried out without the risk of a court battle.

- THE GLOBAL BRIDGE: Coordinated the sale and distribution of Malaysian property for siblings living abroad, handling everything from valuation to the final wire transfer.

🧩 资深实战:化复杂为安心的真实案例

财富管理不只是管理资产,更是管理人生中的各种“万一”。以下是我为不同家庭如何通过专业架构,跨越人生的转折点:

1. 被动收入架构(退休与现金流设计)

提前退休的底气: 协助一位 50 岁的企业主将“卡住”的资产重组为每月固定现金流,让他提前 5 年步入理想的退休生活。

补齐养老缺口: 帮一位退休人士将高风险股票转向稳健的“收入引擎”,确保无论市场如何波动,她的生活品质始终“旱涝保收”。

2. 家族传承守护(遗嘱、信托与子女保障)

单亲妈妈的安全网: 为一位单亲母亲设立保护性信托,锁定孩子的教育基金与生活费,并指定了可靠的监护人,让爱不因意外而中断。

新生儿的成长保障: 协助新手父母在遗嘱之外加设“保险信托”,确保万一发生不幸,理赔金能由专业信托人管理,专款专用直到孩子成年。

跨代大爱延续: 为一位单身专业人士设立“代际关爱信托”,不仅照顾了她的侄辈,还设立了奖学金基金,让她的财富转化为长远的影响力。

3. 企业延续方案(股权演进与接班规划)

遗产认证屏障: 通过设立“商业接班信托”,保护了一家制造公司免受银行账户冻结和债权人追讨的影响,确保企业在交替期依然能正常运转。

公平分配的艺术: 协助一位五金店主将生意传给接班的大儿子,同时通过非业务资产补偿其他子女,在保住生意的同时也保住了家庭的和睦。

4. 危机与特殊规划(失智、纠纷与跨境管理)

失智症预案: 为客户设立“生前信托”,一旦诊断出认知障碍,医疗资金和护理指令将自动激活,不给子女留下艰难的抉择压力。

合法合规的“难言之隐”: 协助一位父亲起草法律严密的遗嘱与解释信,处理复杂的财产分配意愿,确保其真实心愿在法律保护下平稳执行,杜绝后辈诉讼。

跨境财产桥梁: 为身在海外的兄弟姐妹协调马来西亚遗产房产的估价、销售及资金汇出,让远隔重洋的继承过程变得透明且简单。

My greatest achievements are TRUST gained over the years from all my clients and business partners.

Professional Qualifications

Certified Financial Planner (CFP®)

Registered Estate Planner (REP)

Bank Negara Approved Financial Adviser Representative (FAR) under the Financial Services Act 2013

Securities Commission Capital Markets Services Representative Licence (CMSRL) holder under Capital Markets and Services Act 2007 for:

– Financial Planning

– Dealing in Securities (Unit Trust Products)

– Dealing in Private Retirement Schemes

Active member of Financial Planning Association Malaysia (FPAM)

Click here if you wish to share some feedbacks / testimonials.

My Testimonials

Dr Eng

Doctor

Yew Boon & Theng Theng

Business Owner

Cheah Sok Wah

Company Director

Ms Chong

Financial Controller

陈先生

食品批发商

Lim Ewe Tatt

Chief Operating Officer

Eugene Tan

Business Owner

Wealth Strategist | Will & Trust Specialist | Passive Income Architect

The True Meaning of Wealth:

For the first half of life, you work for money. For the second half, your money should work for you.

After 30 years in the financial trenches, I’ve realized that most people’s goals boil down to two simple things:

“LIVING WELL NOW” – Having a steady, monthly cash flow that doesn’t depend on market luck or a paycheck, so retirement doesn’t mean “downgrading.”

“NO DRAMA LATER” – Knowing that if you aren’t around to manage things, the money stays safe, the instructions stay clear, and the family stays united.

True wealth management is about building a reliable income engine today and putting a bulletproof shield around it for tomorrow.

TURNING ASSETS INTO “LIFE SUPPORT”: THE 3 PILLARS

BUILDING YOUR PASSIVE INCOME ENGINE: Real retirement isn’t about a lump sum in the bank; it’s about Cash Flow. I help you “wake up” idle assets and restructure them so that no matter how the economy fluctuates, you have a consistent “monthly salary” hitting your account. That is the definition of true financial peace.

ENSURING MONEY “BEHAVES” AND STAYS PUT: Earning wealth is a skill; keeping it is a strategy. Through Wills and Trusts, we write the “Owner’s Manual” for your money. Whether it’s providing for a spouse or ensuring children receive their inheritance in stages, we make sure every dollar follows your command—not a stranger’s or a court’s.

THE WEALTH FIREWALL: Many business owners have their personal lives and business risks tangled together. We create Risk Isolation. Even if the business faces a storm, your family’s lifestyle remains “all-weather” and untouched.

While YOU are still in the driver’s seat – HOLDING THE STEERING WHEEL, let’s streamline your income for today and pave the road for tomorrow. Life can be spontaneous, but your wealth should be organized.

Click HERE to schedule Peace-of-Mind Conversation with me today!

财富策略师 | 遗嘱与信托专家 | 被动收入架构师

财富的终极意义:前半辈子人赚钱,后半辈子钱养人。

从事金融行业三十年,我发现大家最真实的愿望其实很简单:

一个是**“现在有钱花”——不管行情好不好,每个月都有现金进账,退休生活不降档。

一个是“以后不麻烦”**——万一自己管不动了或者不在了,钱能听话,家不闹腾。

说白了,财富管理就两件事:设计一套源源不断的收入,再给这套收入装一个保护罩。

让资产“活”起来:这三件事是重头戏

打造“被动收入引擎”: 真正的退休不是看存款有多少,而是看现金流有多少。我们会把那些“睡着”的资产叫醒,重新架构,确保无论市场怎么波动,你每个月都有雷打不动的“工资”入账。这叫财务自由的底气。

确保“钱听话,不乱跑”: 赚到钱是本事,留住钱是水平。通过遗嘱和信托,给财富写好“说明书”。不管是想照顾老伴,还是想让孩子细水长流地花钱,都要确保每一分钱都按你的指令走,而不是被外人卷走或被官司耗掉。

给财富装上“防火墙”: 很多老板生意做得大,但家里的钱和公司的账搅在一起。我们要做的就是风险隔离。哪怕外头风大浪大,家里的小日子依然能旱涝保收。

结语:与其为钱奔波,不如让钱为你服务。

所谓的财富规划,其实就是把**“不确定”变成“确定”**。

趁现在看得清、做得了主,把当下的收入流理顺,把未来的传承路铺好。生活可以随性,但财富必须有序。

🧩 Expertise in Action: Real Solutions for Real Lives

I don’t just manage portfolios; I solve the "What Ifs." Here is how I’ve helped others navigate life’s turning points:

1. THE INCOME ARCHITECTS (Retirement & Passive Flow)

- THE "EARLY EXIT": Helped a 50-year-old business owner restructure "stuck" assets into a monthly cash flow, giving him the confidence to retire 5 years early.

- THE PENSION GAP: Assisted a retiree in shifting from high-risk stocks to a stable "Income Engine," ensuring her lifestyle stayed "all-weather" despite market drops.

2. THE LEGACY PROTECTORS (Wills, Trusts & Children)

- THE SINGLE PARENT‘S SAFETY NET: Set up a protective Trust for a divorced mother, ensuring her children’s education and daily needs are funded and a legal guardian is locked in.

- THE "MINOR CHILD" GUARANTEE: Helped new parents move beyond a simple Will by creating an Insurance Trust, ensuring payouts are managed by a professional for their child’s future.

- THE CHILDLESS LEGACY: Guided a single professional in creating a "Generational Love" Trust for her nieces and a charitable foundation to fund scholarships in her name.

3. THE BUSINESS GUARDIANS (Succession & Continuity)

- THE PROBATE SHIELD: Protected a manufacturing firm from frozen bank accounts and creditor demands by moving the company shares into a Succession Trust.

- THE "FAIRNESS" BALANCE: Helped a hardware store owner pass the business to his active son while providing equal "non-business" value to his other children to keep the family happy.

4. THE CRISIS MANAGERS (Dementia, Dispute & Distance)

- THE DEMENTIA DIRECTIVE: Set up a Living Trust for a client that automatically triggers medical funding and care instructions upon a diagnosis of cognitive decline.

- THE "TOUGH LOVE" WILL: Drafted a legally ironclad estate plan for a father wishing to disinherit a child, ensuring his wishes were carried out without the risk of a court battle.

- THE GLOBAL BRIDGE: Coordinated the sale and distribution of Malaysian property for siblings living abroad, handling everything from valuation to the final wire transfer.

🧩 资深实战:化复杂为安心的真实案例

财富管理不只是管理资产,更是管理人生中的各种“万一”。以下是我为不同家庭如何通过专业架构,跨越人生的转折点:

1. 被动收入架构(退休与现金流设计)

提前退休的底气: 协助一位 50 岁的企业主将“卡住”的资产重组为每月固定现金流,让他提前 5 年步入理想的退休生活。

补齐养老缺口: 帮一位退休人士将高风险股票转向稳健的“收入引擎”,确保无论市场如何波动,她的生活品质始终“旱涝保收”。

2. 家族传承守护(遗嘱、信托与子女保障)

单亲妈妈的安全网: 为一位单亲母亲设立保护性信托,锁定孩子的教育基金与生活费,并指定了可靠的监护人,让爱不因意外而中断。

新生儿的成长保障: 协助新手父母在遗嘱之外加设“保险信托”,确保万一发生不幸,理赔金能由专业信托人管理,专款专用直到孩子成年。

跨代大爱延续: 为一位单身专业人士设立“代际关爱信托”,不仅照顾了她的侄辈,还设立了奖学金基金,让她的财富转化为长远的影响力。

3. 企业延续方案(股权演进与接班规划)

遗产认证屏障: 通过设立“商业接班信托”,保护了一家制造公司免受银行账户冻结和债权人追讨的影响,确保企业在交替期依然能正常运转。

公平分配的艺术: 协助一位五金店主将生意传给接班的大儿子,同时通过非业务资产补偿其他子女,在保住生意的同时也保住了家庭的和睦。

4. 危机与特殊规划(失智、纠纷与跨境管理)

失智症预案: 为客户设立“生前信托”,一旦诊断出认知障碍,医疗资金和护理指令将自动激活,不给子女留下艰难的抉择压力。

合法合规的“难言之隐”: 协助一位父亲起草法律严密的遗嘱与解释信,处理复杂的财产分配意愿,确保其真实心愿在法律保护下平稳执行,杜绝后辈诉讼。

跨境财产桥梁: 为身在海外的兄弟姐妹协调马来西亚遗产房产的估价、销售及资金汇出,让远隔重洋的继承过程变得透明且简单。

My greatest achievements are TRUST gained over the years from all my clients and business partners.

Professional Qualifications

Certified Financial Planner (CFP®)

Registered Estate Planner (REP)

Bank Negara Approved Financial Adviser Representative (FAR) under the Financial Services Act 2013

Securities Commission Capital Markets Services Representative Licence (CMSRL) holder under Capital Markets and Services Act 2007 for:

– Financial Planning

– Dealing in Securities (Unit Trust Products)

– Dealing in Private Retirement Schemes

Active member of Financial Planning Association Malaysia (FPAM)

Click here if you wish to share some feedbacks / testimonials.

My Services

My Content

Testimonials

Dr Eng

Doctor

Yew Boon & Theng Theng

Business Owner

Cheah Sok Wah

Company Director

Ms Chong

Financial Controller

陈先生

食品批发商

Lim Ewe Tatt

Chief Operating Officer

Eugene Tan

Business Owner

Contact Me

ACKNOWLEDGEMENT

By submitting this form, I confirm that

- I have read and understood FA Advisory Sdn Bhd.’s (FAA) Personal Data Policy, and hereby give my acknowledgement and consent to FAA to use my personal data in accordance with FAA’s Personal Data Policy.

- I have read and understood the disclaimers above and hereby affirm my acceptance of these terms.

- I have not been directly contacted or approached by any representative or employee of FAA with an offer or solicitation to apply for any financial products not offered in my home country.

Scan for Contact Details

Join our newsletter

Subscribe to our newsletter to receive updates on our latest content!