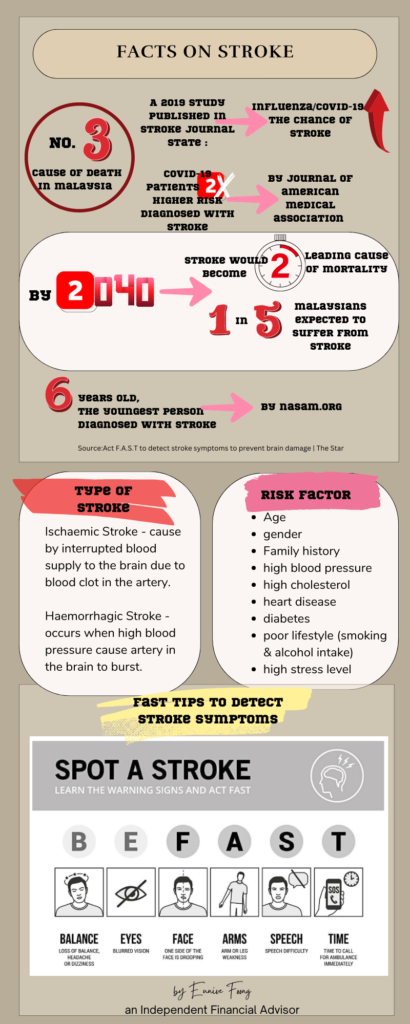

Facts on Stroke and how it affect our daily living

Stroke is the 𝟹ʀᴅ ᴍᴀɪɴ ᴄᴀᴜsᴇ ᴏғ ᴅᴇᴀᴛʜ in Malaysia. However, тιмє ιѕ єѕѕєитιαℓ if want to treat stroke effectively.

According to consultant neurologist Dr. Kok Chin Yong. your brain cells will start to die within minutes after the stroke hits you – about 2,000,000 cells every minute.

Having a ᗰᗴᗪIᑕᗩᒪ ᑭᒪᗩᑎ means you get covered during hospitalization during stroke attack. But then, during the ɾҽϲօѵҽɾվ ՏԵɑցҽ, patients need to do rehabilitation, physical therapy, alternative treatments and take extra supplements that are иσт ¢σνєяє∂ ву тнє мє∂ι¢αℓ ρℓαи IF you do not include CRITICAL ILLNESS PLAN inside your medical plan.

The most important is the ƤƛƬƖЄƝƬ ƝЄЄƊƧ MƠƝЄƳ to cover income loss due to taking long leave than expected for a full recovery but ғɪxᴇᴅ ᴇxᴘᴇɴsᴇs such as mortgages and ℓινιиg єχρєиѕєѕ need to pay on time.

A critical illness plan helps to ραу συт α ℓυмρ ѕυм σf мσиєу to the life assured to cover their loss of income and used the pay out to pay fixed expenses.

If today you only have RM50K or RM100K in your critical illness plan, how long can it be sustainable? It will depend on how much you need to spend every month.

Let’s say your мσитнℓу єχρєиѕєѕ ιѕ ям10к. RM50K pay out only last for 5 months and after that, you need to cash out the emergency funds and investment to support day-to-day living. You can use your own saving to pay for it, but after the savings dried out, the life assured needs to start all over again. At that point in time, does this person still physically and mentally fit to apply for a new job?

A critical illness plan enables the life assured to have a ρєα¢є σf мιи∂ and fully concentrate on recovery. However, there’s a rule of thumb on how much you need to cover for income loss.

If you want to know whether you have enough coverage on critical illness, check out with me to have a clear figure in hand.

ᴍɪɴɪᴍɪᴢᴇ ʏᴏᴜʀ ʀɪsᴋ ʙʏ ᴛʀᴀɴsғᴇʀʀɪɴɢ ɪᴛ ᴛᴏ ᴀ ᴛʜɪʀᴅ ᴘᴀʀᴛʏ. Just like how you protect your car by buying car insurance or protect your business from loss of profit.

Bye for now and looking forward to hear from you.