个案分享(1) 遗产规划:

学习篇:

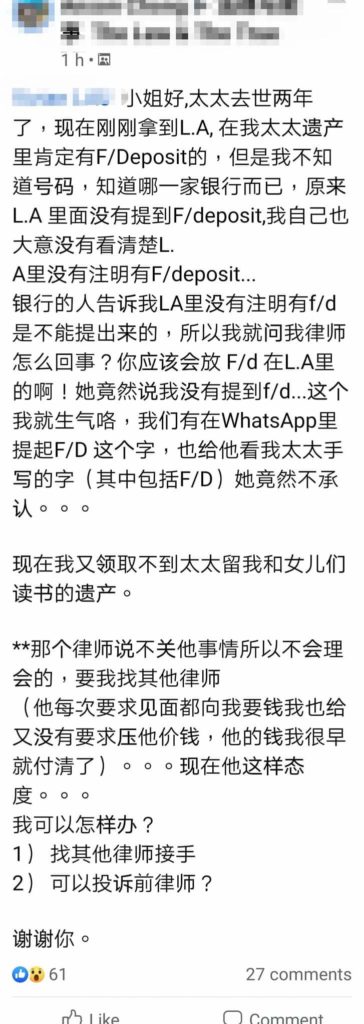

遇到以上情形,唯一能做的就是重新申请LA (Letter of Administration)。因为银行必须跟着程序走。当然手续又多一层了,后续的跟进速度也慢了。

问:该如何避免类似情况发生?

答:在做遗产规划时,咨询有经验的规划师。一位有经验的规划师会在初步的勘探阶段为你提供个案分析,有利于日后的规划,才能避免许多不必要的麻烦。尤其是被委任的执行人完全没有这方面的经验,就会延长整个手续过程。在做规划之前,一定要先准备产业清单:

1)所有的不动产资料(正确地址,地契备份,贷款银行及余额等,共同拥有者)

2)所有名下的企业(基本资料,合伙人资料)

3)所有动产资料(汽车,银行户口,私人俱乐部会员,Paypal, TouchNGo, Shopee, 股票户口,虚拟货币账号等等)

除了产业清单,也要准备债务清单。

欲了解更多,请按此处链接,我将会尽快联络您。

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs.

Published By:

Samantha Lim 林淑燕

Wealth Strategist | Will & Trust Specialist | Passive Income Architect

The True Meaning of Wealth:

For the first half of life, you work for money. For the second half, your money should work for you.

After 30 years in the financial trenches, I’ve realized that most people’s goals boil down to two simple things:

“LIVING WELL NOW” – Having a steady, monthly cash flow that doesn’t depend on market luck or a paycheck, so retirement doesn’t mean “downgrading.”

“NO DRAMA LATER” – Knowing that if you aren’t around to manage things, the money stays safe, the instructions stay clear, and the family stays united.

True wealth management is about building a reliable income engine today and putting a bulletproof shield around it for tomorrow.

TURNING ASSETS INTO “LIFE SUPPORT”: THE 3 PILLARS

BUILDING YOUR PASSIVE INCOME ENGINE: Real retirement isn’t about a lump sum in the bank; it’s about Cash Flow. I help you “wake up” idle assets and restructure them so that no matter how the economy fluctuates, you have a consistent “monthly salary” hitting your account. That is the definition of true financial peace.

ENSURING MONEY “BEHAVES” AND STAYS PUT: Earning wealth is a skill; keeping it is a strategy. Through Wills and Trusts, we write the “Owner’s Manual” for your money. Whether it’s providing for a spouse or ensuring children receive their inheritance in stages, we make sure every dollar follows your command—not a stranger’s or a court’s.

THE WEALTH FIREWALL: Many business owners have their personal lives and business risks tangled together. We create Risk Isolation. Even if the business faces a storm, your family’s lifestyle remains “all-weather” and untouched.

While YOU are still in the driver’s seat – HOLDING THE STEERING WHEEL, let’s streamline your income for today and pave the road for tomorrow. Life can be spontaneous, but your wealth should be organized.

Click HERE to schedule Peace-of-Mind Conversation with me today!

财富策略师 | 遗嘱与信托专家 | 被动收入架构师

财富的终极意义:前半辈子人赚钱,后半辈子钱养人。

从事金融行业三十年,我发现大家最真实的愿望其实很简单:

一个是**“现在有钱花”——不管行情好不好,每个月都有现金进账,退休生活不降档。

一个是“以后不麻烦”**——万一自己管不动了或者不在了,钱能听话,家不闹腾。

说白了,财富管理就两件事:设计一套源源不断的收入,再给这套收入装一个保护罩。

让资产“活”起来:这三件事是重头戏

打造“被动收入引擎”: 真正的退休不是看存款有多少,而是看现金流有多少。我们会把那些“睡着”的资产叫醒,重新架构,确保无论市场怎么波动,你每个月都有雷打不动的“工资”入账。这叫财务自由的底气。

确保“钱听话,不乱跑”: 赚到钱是本事,留住钱是水平。通过遗嘱和信托,给财富写好“说明书”。不管是想照顾老伴,还是想让孩子细水长流地花钱,都要确保每一分钱都按你的指令走,而不是被外人卷走或被官司耗掉。

给财富装上“防火墙”: 很多老板生意做得大,但家里的钱和公司的账搅在一起。我们要做的就是风险隔离。哪怕外头风大浪大,家里的小日子依然能旱涝保收。

结语:与其为钱奔波,不如让钱为你服务。

所谓的财富规划,其实就是把**“不确定”变成“确定”**。

趁现在看得清、做得了主,把当下的收入流理顺,把未来的传承路铺好。生活可以随性,但财富必须有序。